MB-310 : Microsoft Dynamics 365 Finance : Part 01

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

You are configuring the year-end setup in Dynamics 365 Finance.

You need to configure the year-end setup to meet the following requirements:

– The accounting adjustments that are received in the first quarter must be able to be posted into the previous year’s Period 13.

– The fiscal year closing can be run again, but only the most recent closing entry will remain in the transactions.

– All dimensions from profit and loss must carry over into the retained earnings.

– All future and previous periods must have an On Hold status.Solution:

– Configure General ledger parameters.

– Set the Delete close of year transactions option to Yes.

– Set the Create closing transactions during transfer option to Yes.

– Set the Fiscal year status to permanently closed option to No.

Define the Year-end close template.

– Designate a retained earnings main account for each legal entity.

– Set the Financial dimensions will be used on the Opening transactions option to No.

– Set the Transfer profit and loss dimensions option to Close All.

Set all prior and future Ledger periods to a status of On Hold.Does the solution meet the goal?

- Yes

- No

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

You are configuring the year-end setup in Dynamics 365 Finance.

You need to configure the year-end setup to meet the following requirements:

The accounting adjustments that are received in the first quarter must be able to be posted into the previous year’s Period 13.

The fiscal year closing can be run again, but only the most recent closing entry will remain in the transactions.

All dimensions from profit and loss must carry over into the retained earnings.

All future and previous periods must have an On Hold status.Solution:

Configure General ledger parameters.

– Set the Delete close of year transactions option to Yes.

– Set the Create closing transactions during transfer option to Yes.

– Set the Fiscal year status to permanently closed option to Yes.

Define the Year-end close template.

– Designate a retained earnings main account for each legal entity.

– Set the Financial dimensions will be used on the Opening transactions option to Yes.

– Set the Transfer profit and loss dimensions to Close All.

Set all prior and future Ledger periods to a status of On Hold.Does the solution meet the goal?

- Yes

- No

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

You are configuring the year-end setup in Dynamics 365 Finance.

You need to configure the year-end setup to meet the following requirements:

– The accounting adjustments that are received in the first quarter must be able to be posted into the previous year’s Period 13.

– The fiscal year closing can be run again, but only the most recent closing entry will remain in the transactions.

– All dimensions from profit and loss must carry over into the retained earnings.

– All future and previous periods must have an On Hold status.Solution:

– Configure General ledger parameters.

– Set the Delete close of year transactions option to No.

– Set the Create closing transactions during transfer option to No.

– Set the Fiscal year status to permanently closed option to No.

– Define the Year-end close template.

– Designate a retained earnings main account for each legal entity.

– Set the Financial dimensions will be used on the Opening transactions option to No.

– Set the Transfer profit and loss dimensions to Close All.

Set all prior and future Ledger periods to a status of On Hold.Does the solution meet the goal?

- Yes

- No

-

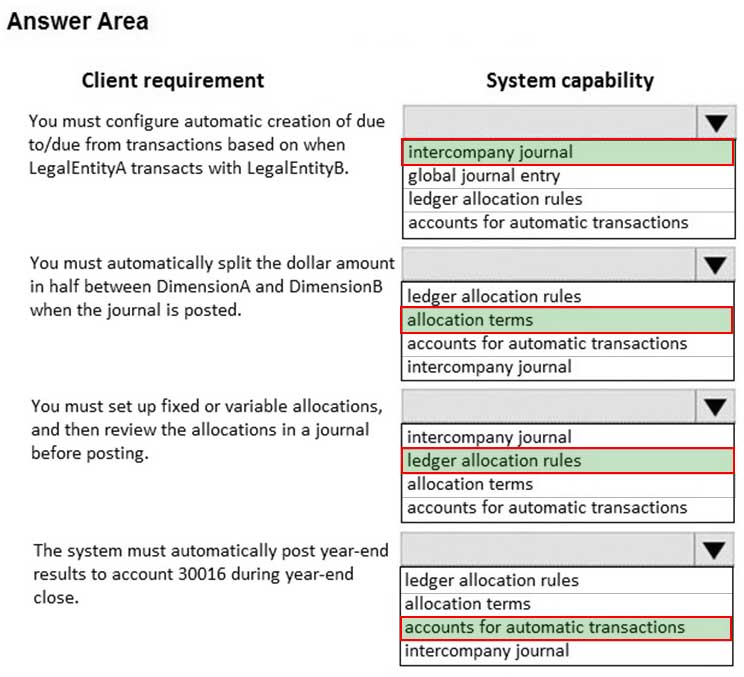

HOTSPOT

You are implementing a Dynamics 365 Finance general ledger module for a client that has multiple legal entities.

The client has the following requirements:

Configure automatic creation of due to/due from transactions based on when LegalEntityA transacts with LegalEntityB.

Automatically split the dollar amount in half between DimensionA and DimensionB when the journal is posted.

Set up fixed or variable allocations, and then review the allocations in a journal before posting.

Automatically post year-end results to account 30016 during year-end close.You need to configure the system.

Which system capability should you configure? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 01 Q01 001 Question

MB-310 Microsoft Dynamics 365 Finance Part 01 Q01 001 Answer -

A company is preparing to complete a year-end close process.

You need to configure the Dynamics 365 Finance General ledger module.

Which three configurations must you use? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Configure the Fiscal year close parameters

- Configure the ledger calendar for the new fiscal year

- Set up the year end close template

- Validate the main account type

- Create the next fiscal year

Explanation:This question is asking about configuring the system. Answers A (Configure the Fiscal year close parameters), D (Validate the main account type) and E (Create the next fiscal year) are required to configure the system.

The next step after configuring the system would be Answer C (Set up the year end close template).After the system is configured, the year-end close process can be run. On the Year-end close page, a template can be defined for the group of legal entities for which the year-end close process will be run. The template will be reused at each year-end close, but can be modified if your organization changes.

-

A client has unique accounting needs that sometimes require posting definitions.

You need to implement posting definitions.

In which situation should you implement posting definitions?

- when financial dimensions need to default from the vendor record onto an invoice

- when only certain dimensions are allowed to post with certain main account combinations

- when creating multiple balanced ledger entries based on transaction types or accounts

- when the system needs to automatically post a transaction to the accounts receivable account on invoice posting

-

An organization is setting up a cost accounting.

You need to set up fiscal calendars for Dynamics 365 Finance.

What are three uses for fiscal calendars? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- standard work hours

- financial transactions

- fixed asset depreciation

- budget cycles

- shift work hours

-

You are configuring automatic bank reconciliation functionality for a company that has multiple bank accounts. The company wants to import their bank statements.

You need to import electronic bank statements to reconcile the bank accounts.

Which three actions can you perform? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- Select all the bank accounts for the bank statement files, and then upload all files

- Select Account reconciliation on the bank account form

- Import bank statements from the Data management workspace

- Navigate to Import statement on the Bank Statements page of Cash and Bank Management

- Select Import statement for multiple bank accounts in all legal entities, and then upload a zip file

-

A company plans to create a new allocation rule for electric utilities expenses.

The allocation rule must meet the following requirements:

– Distribute overhead utility expense to each department.

– Define how and in what proportion the source amounts must be distributed on various destination lines.You need to configure the allocation rule.

Which allocation method should you use?

- Distribute the source document amount equally

- Fixed weight

- Equally

- Basis

-

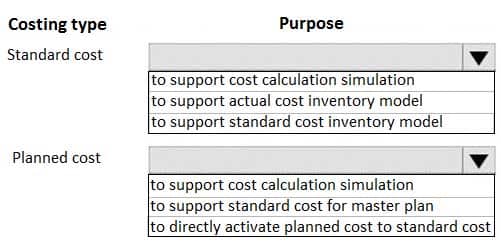

HOTSPOT

A food manufacturer uses commodities such as beans, corn, and chili peppers as raw materials. The prices of the commodities fluctuate frequently. The manufacturer wants to use cost versions to simulate these fluctuations.

You need to set up cost versions and prices to accomplish the manufacturer’s goal.

For which purpose should you use each costing type? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 01 Q10 002 Question

MB-310 Microsoft Dynamics 365 Finance Part 01 Q10 002 Answer -

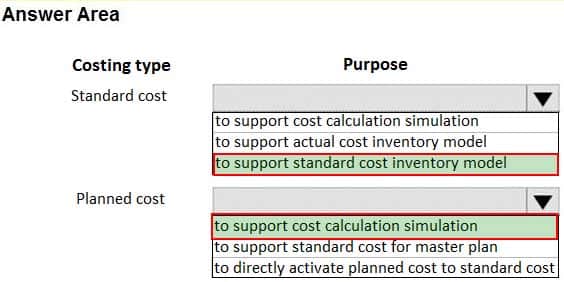

HOTSPOT

A rental service company hires you to configure their system to implement accrual schemes.

You need to configure the accrual schemes for the company for both rentals and associated expenses.

Which configuration and transaction options should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 01 Q11 003 Question

MB-310 Microsoft Dynamics 365 Finance Part 01 Q11 003 Answer -

A company provides employee life insurance to all full-time employees. Employee life insurance policies are paid twice a year to the insurance company.

Transactions for current employees must be recognized in the general ledger twice a month with an employee’s pay. Transactions for new employees must be recognized in the general ledger based upon the employee’s first pay date.

You need to configure accrual schemes for the new fiscal year.

Which two configurations should you use? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- For new employees, use a Credit accrual scheme. In the ledger accrual, set the offset to the first day of the fiscal year.

- For current employees, use a Credit accrual scheme. In the ledger accrual, set the offset to the employee’s first pay date.

- For new employees, use a Debit accrual scheme. In the ledger accrual, set the offset to the employee’s first pay date.

- For current employees, use a Debit accrual scheme. In the ledger accrual, set the offset to the first day of the fiscal year.

-

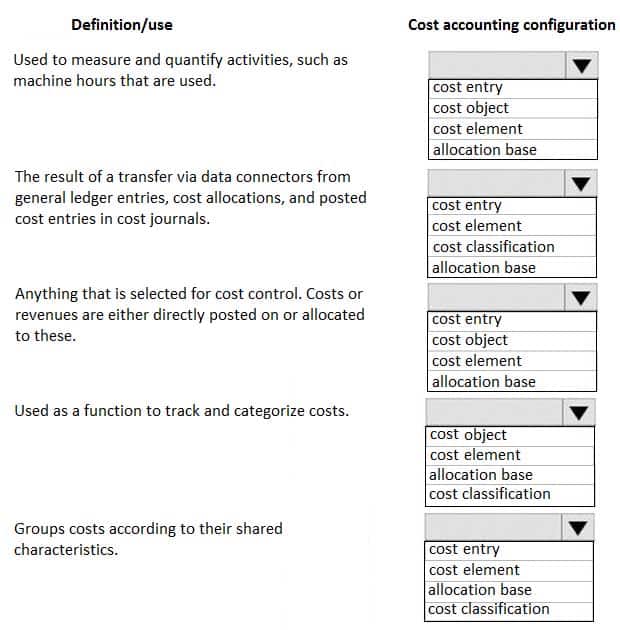

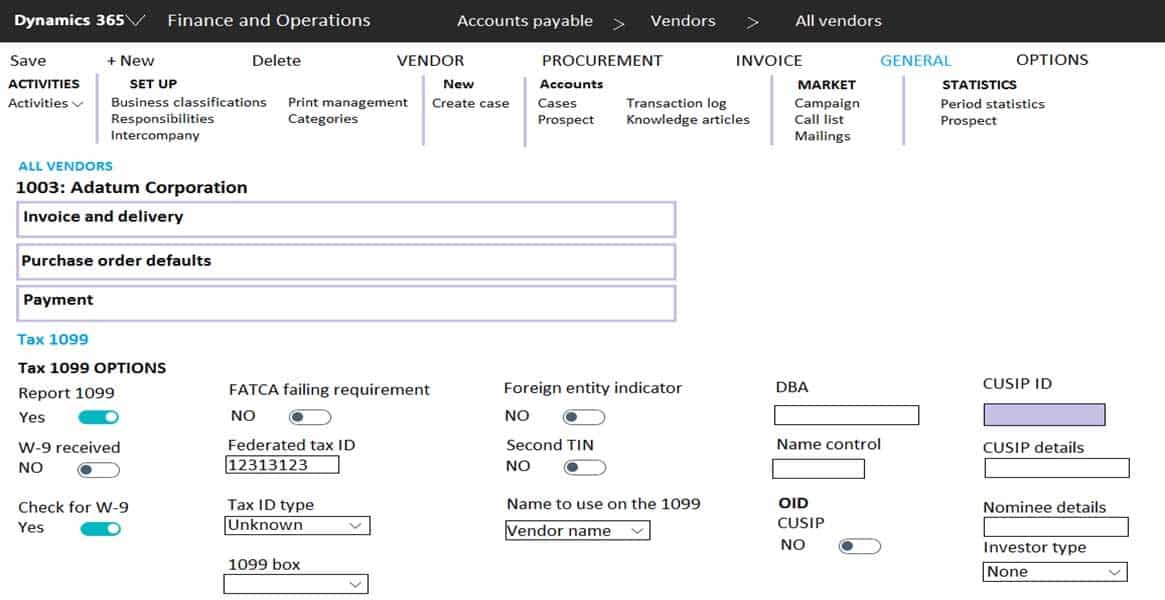

HOTSPOT

A client plans to use the cost accounting module in Dynamics 365 Finance.

You need to associate the correct definitions to the correct cost accounting concepts.

Which terms match the definitions? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 01 Q13 004 Question

MB-310 Microsoft Dynamics 365 Finance Part 01 Q13 004 Answer -

An organization uses Dynamics 365 Finance.

Several posted journal entries contain invalid main account and dimension combinations. This leads to incorrect financial reporting.

You need to prevent these invalid combinations.

What should you do?

- Configure the account structure to specify which financial dimensions are valid for which main accounts.

- Train users to select the Validate button in the current journal configuration so that the correct account and dimension combination is used.

- Configure financial dimension sets to limit which financial dimensions are valid for which main accounts.

- Associate the correct main accounts to that financial dimension on the financial dimension setup form.

-

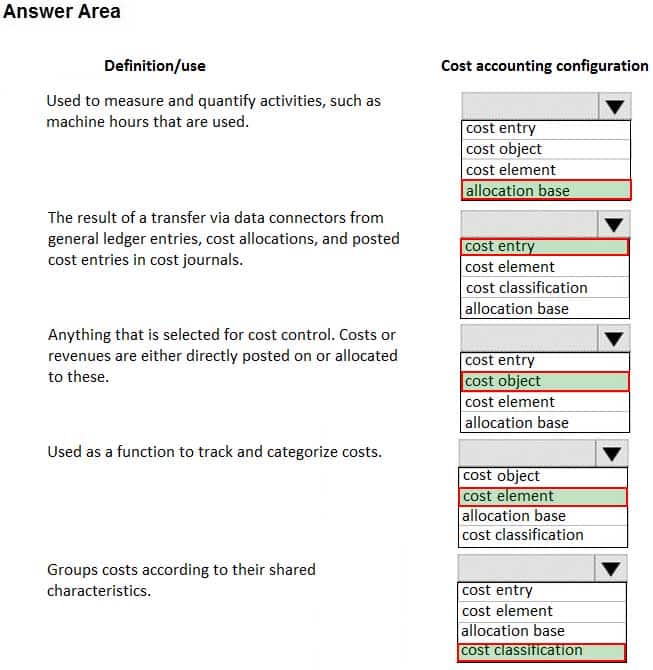

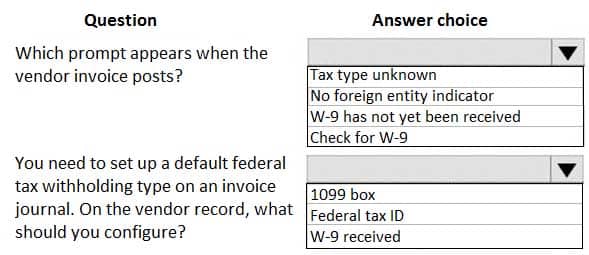

HOTSPOT

A client plans to use Dynamics 365 Finance for year-end 1099 reporting in the United States.

You are viewing a vendor master data record on the 1099 FastTab.

MB-310 Microsoft Dynamics 365 Finance Part 01 Q15 005 Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 01 Q15 006 Question

MB-310 Microsoft Dynamics 365 Finance Part 01 Q15 006 Answer -

A legal entity has locations and customers in multiple states within the United States.

You need to ensure that taxable customers are charged sales tax for taxable items in their delivery location.

Which three settings must you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- the Sales tax group on the Customer record

- the Terms of delivery setup

- the Item Sales tax group on the Item record

- the Sales reporting codes

- the Sales tax codes

-

You are configuring Dynamics 365 Finance.

You need to implement posting definitions for all available transaction types.

For which type of transactions can you implement posting definitions?

- Accounts payable, Accounts receivable, Bank, Budget, Payroll, and Purchasing

- Accounts payable, Bank, Budget, Fixed assets, and Payroll

- Accounts payable, Accounts receivable, Fixed assets, Payroll, and Purchasing

- Accounts payable, Accounts receivable, Budget, and Fixed assets

-

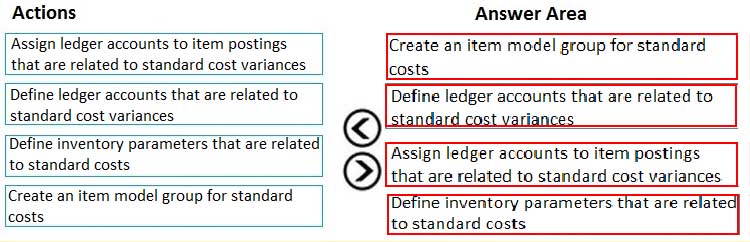

DRAG DROP

You need to set up a process of tracking, recording, and analyzing costs associated with the products or activities of a nonmanufacturing organization.

You need to configure the prerequisite setup for the standard costing version for the current period.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

MB-310 Microsoft Dynamics 365 Finance Part 01 Q18 007 Question

MB-310 Microsoft Dynamics 365 Finance Part 01 Q18 007 Answer -

A public sector company is configuring encumbrance for managing capital budgets.

The finance department needs to configure posting definitions for bank transactions.

You need to configure Dynamics 365 Finance for cash settlements.

What should you do?

- Configure combined deposit amounts

- Configure budget appropriations

- Configure general ledger year-end close

- Configure advanced ledger entries

-

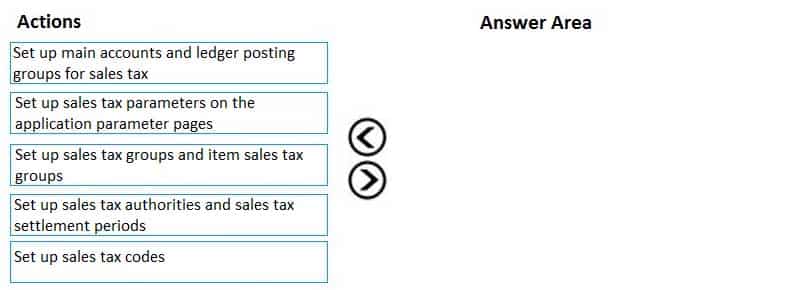

DRAG DROP

A retail company has outlets in multiple locations. Taxes vary depending on the location.

You need to configure the various components of the tax framework.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

MB-310 Microsoft Dynamics 365 Finance Part 01 Q20 008 Question

MB-310 Microsoft Dynamics 365 Finance Part 01 Q20 008 Answer