MB-310 : Microsoft Dynamics 365 Finance : Part 02

-

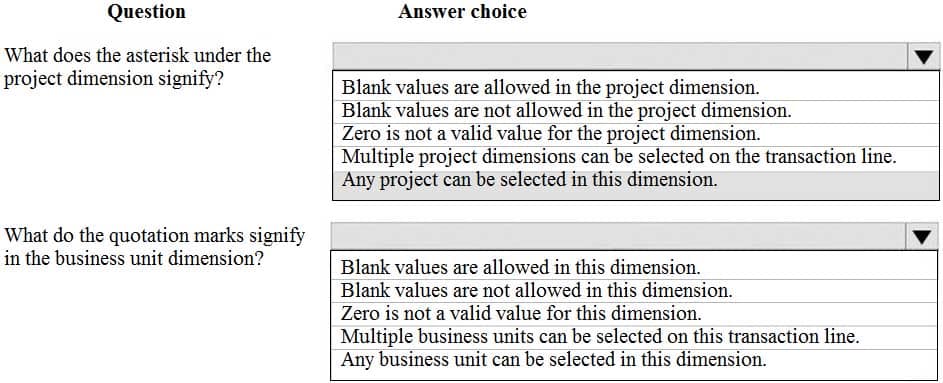

HOTSPOT

A client wants to ensure that transactions posted to the General Ledger have the correct combination of account number and dimensions.

The Services Industry P&L Account Structure has the following information:

MB-310 Microsoft Dynamics 365 Finance Part 02 Q01 009 Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 02 Q01 010 Question

MB-310 Microsoft Dynamics 365 Finance Part 02 Q01 010 Answer -

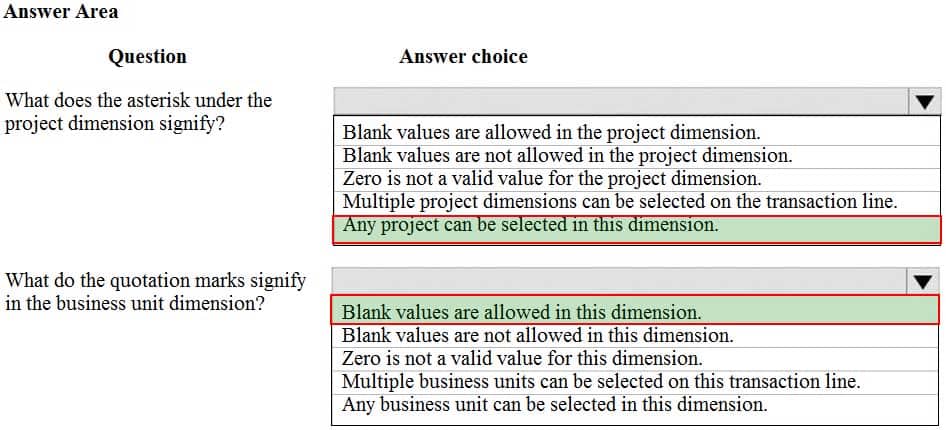

HOTSPOT

A rental service company with complex accrual requirements has accrual schemes set up in its implementation. They want to use defined accrual schemes to perform transactions.

You need to use an accrual scheme to create transactions for this company.

Which actions should you perform? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 02 Q02 011 Question

MB-310 Microsoft Dynamics 365 Finance Part 02 Q02 011 Answer -

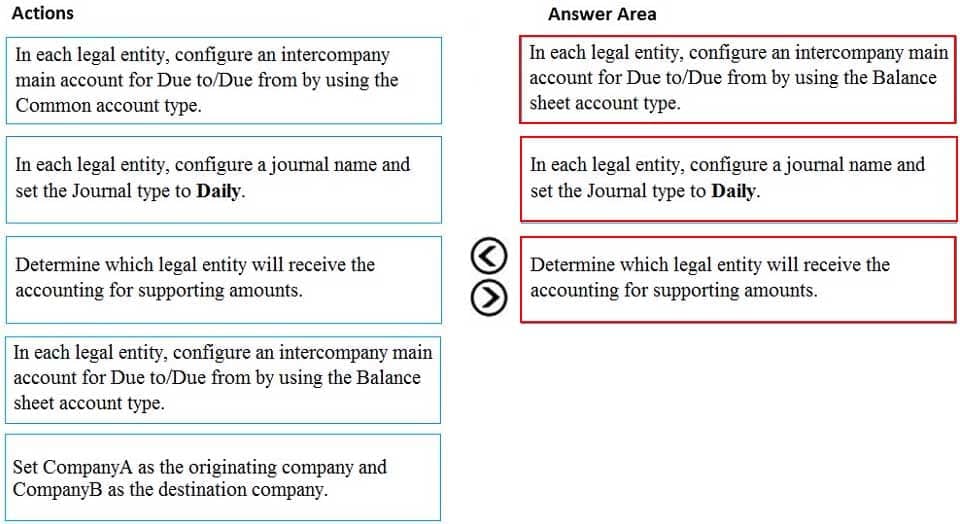

DRAG DROP

You are configuring a Dynamics 365 Finance environment for intercompany accounting. You create the following legal entities:

– Company A

– Company BYou need to configure intercompany accounting for both legal entities.

Which three actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

MB-310 Microsoft Dynamics 365 Finance Part 02 Q03 012 Question

MB-310 Microsoft Dynamics 365 Finance Part 02 Q03 012 Answer -

An organization plans to set up intercompany accounting between legal entities within the organization.

Automatic transactions between legal entities must meet the following requirements:

– Provide systemwide integration and streamlining to save time.

– Minimize errors and create an audit trail with full visibility into business activities and transaction histories within the legal entities.You need to set up intercompany accounting and create pairs of legal entities that can transact with each other, clearly defining the originating company and the destination company.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Select intercompany journal names.

- Configure intercompany accounting in both the originating entity and destination entity.

- Create intercompany main accounts to use for the due to and due from accounting entries.

- Define intercompany accounting setup by creating legal entity pairs defining originating and destination companies.

- Configure intercompany accounting in the destination entity only.

-

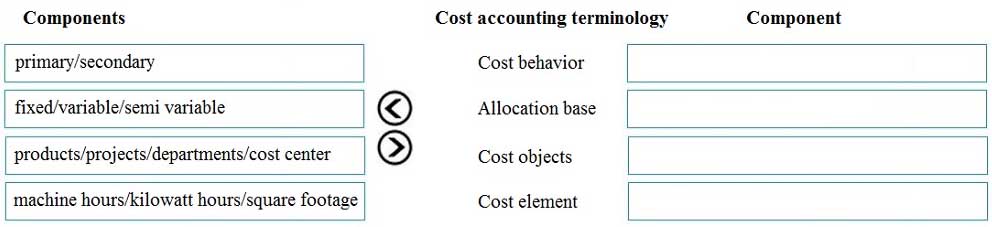

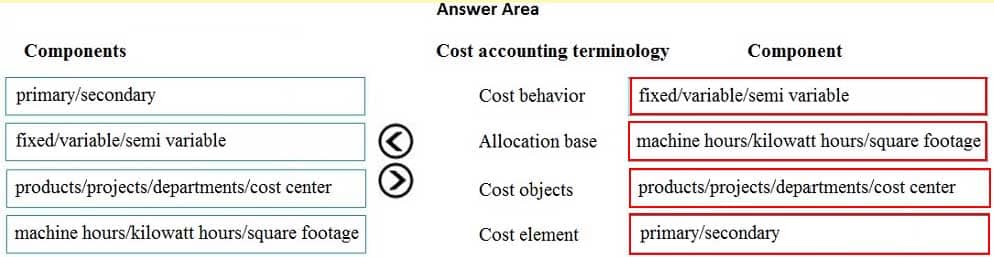

DRAG DROP

You are a controller in an organization. You are identifying cost drivers to see how changes in business activities affect the bottom line of your organization. You need to assess cost object performance to analyze actual versus budgeted cost and how resources are consumed.

You need to demonstrate your understanding of cost accounting terminology.

Which component maps to the cost accounting terminology?

To answer, drag the appropriate component to the correct cost accounting terminology. Each source may be used once. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 02 Q05 013 Question

MB-310 Microsoft Dynamics 365 Finance Part 02 Q05 013 Answer -

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to implement a quarterly accruals scheme for USMF. The accrual scheme settings must match the settings of the monthly and annual accrual schemes.

To complete this task, sign in to the Dynamics 365 portal.

- See explanation below.

Explanation:Look at the monthly and annual accrual scheme settings. Create a quarterly accrual scheme with the same settings by using the following instructions:

1. Go to Navigation pane > Modules > General ledger > Journal setup > Accrual schemes.

2. Select New.

3. In the Accrual identification field, type a value.

4. In the Description of accrual scheme field, type a value.

5. In the Debit field, specify the desired values. The main account defined will replace the debit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

6. In the Credit field, specify the desired values. The main account defined will replace the credit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

7. In the Voucher field, select how you want the voucher determined when the transactions are posted.

8. In the Description field, type a value to describe the transactions that will be posted.

9. In the Period frequency field, select how often the transactions should occur.

10. In the Number of occurrences by period field, enter a number.

11. In the Post transactions field, select when the transactions should be posted, such as Monthly. -

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

USMF plans to implement a new manufacturing department that will be based in Australia.

You need to create a draft account structure for the new department. The account structure must use the same account structure as a department named Manufacturing India and be named Manufacturing Australia.

To complete this task, sign in to the Dynamics 365 portal.

- See explanation below.

Explanation:You need to create an account structure with the same structure as the department named Manufacturing India by using the following instructions.

1. Go to Navigation pane > Modules > General ledger > Chart of accounts > Structures > Configure account structures.

2. On the Action pane, click New to open the drop dialog.

3. In the Account structure field, type a name to describe the purpose of the account structure.

4. In the Description field, type a description to specify the purpose of the account structure.

5. Click Create.

6. In the Segments and allowed values, click Add segment.

7. In the dimensions list, select the dimension to add to the account structure.

8. At the end of the list, click Add segment.

9. Repeat step 6 to 9 as needed.

10. In the Allowed value details section, select the segment to edit the allowed values. For example, click the Main Account field.

11. In the Operator field, select an option, such as is between and includes.

12. In the Value field, type a value. For example, 600000.

13. In the through field, type a value. For example, 699999.

14. In the Allowed value details section, click Apply.

15. Repeat step 10 to 15 as needed.

16. In the Allowed value details section, click Add new criteria.

17. In the Operator field, select an option, such as is between and includes.

18. In the Value field, type a value. For example, 033.

19. In the through field, type a value. For example, 034.

20. Click Apply.

21. In the grid, select the segment to edit the allowed values. For example, Cost Center.

22. In the Cost Center field, type a value. For example, 007..021.

23. In the Segments and allowed values, click Add.

24. In the Main Account field, type a value. For example, 600000..699999

25. In the grid, select the segment to edit the allowed values. For example, Department.

26. In the Department field, type a value. For example, 032.

27. In the Cost Center field, type a value. For example, 086.

28. On the Action pane, click Validate. -

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to assign the Accountant closing role for the USMF legal entity to an employee named Theresa Jayne.

To complete this task, sign in to the Dynamics 365 portal.

- See explanation below.

Explanation:1. Navigate to System administration > Security > Assign users to roles

2. Select the ‘Accountant Closing’ role.

3. Click the “Manually assign / exclude users” button

4. Select the Theresa Jayne user account and click the “Assign to role” button.

5. Click the “Assign organizations” button

6. Select the “Grant access to specific organizations” option

7. Select the USMF legal entity and click the “Grant” button. -

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to create a report that contains the sales tax settlements for the state of California during the quarter that began on January 1, 2017. To validate you results, save the file in Microsoft Excel format to the Downloads\Report folder.

To complete this task, sign in to the Dynamics 365 portal.

- See explanation below.

Explanation:1. Navigate to Tax > Declarations > Report sales tax for settlement period.

2. Enter the ‘From’ date.

3. Select the settlement period (Quarter).

4. Click ‘OK’.

5. Select Yes in the Create electronic tax document field.

6. Select the Downloads\Report folder and file format.

7. Click ‘OK’. -

You are a Dynamics 365 Finance expert for an organization.

You need to configure the Financial period close workspace.

Which three configuration processes should you use? Each correct answer presents a part of the solution.

NOTE: Each correct selection is worth one point.

- Create templates that contain the required tasks within the closing process and assign to closing role.

- Create a separate closing schedule for every legal entity.

- Assign a ledger calendar to the closing process.

- Create task areas and descriptions.

- Designate resources and their scope based on closing roles.

-

You are a Dynamics 365 Finance consultant.

You are currently unable to collaborate or track progress toward month-end close across legal entities in the current system.

You need to resolve the issue.

What should you configure?

- Financial reporting

- Financial insights workspace

- Electronic reporting

- Financial period close workspace

-

You are a Dynamics 365 Finance consultant. You plan to configure the allocation base, cost behavior, and cost distribution.

Which three actions do these configurations accomplish? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- Spread costs from one cost object to one or more other cost objects by applying a relevant allocation base.

- Measure and quantify activities, such as machine hours that are used, kilowatt hours that are consumed, or square footage that is occupied.

- Spread the balance of the cost from one cost object to one or more other cost objects by applying a relevant allocation base.

- Control which journals can be used in the costing process.

- Classify costs according to their behavior in relation to changes in key business activities.

-

You are a finance consultant. Your client needs you to configure cash flow forecasting.

The client wants specific percentages of main accounts to contribute to different cash flow forecasts for other main accounts.

You need to configure Dynamics 365 for Finance to meet the needs of the client.

What should you do?

- On the Cash flow forecasting setup form, configure the primary main account to assign a percentage to the dependent account.

- Configure the parent/child relationship for the main account and subaccounts by using appropriate percentages.

- Configure the cash flow forecasting setup for Accounts Payable before you configure vendor posting profiles.

- On the Cash flow forecasting setup form, use the Dependent Accounts setup to specify which account and percentage is associated to the main account.

-

A company plans to use Dynamics 365 Finance to calculate sales tax on sales orders.

You need to automatically calculate sales tax when the sales order is created.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Assign values to the sales tax codes and assign the sales tax codes to the sales tax group associated to the customer.

- Assign all sales tax codes to the item sales tax group associated to the item being sold.

- Set up a default item sales tax group on the item being sold and set up a default sales tax group on the customer used on the sales order.

- Associate the sales tax jurisdictions to the item sales tax group associated to the item being sold.

- Set up a default sales tax code on the customer used on the sales order and set up a default item sales tax group on the item being sold.

-

A client wants Dynamics 365 Finance to calculate sales tax on a sales order line once an item is added. The sales tax group is already populated with a value.

You need to ensure that the sales tax will calculate.

Which field should you populate?

- sales tax code

- item group

- customer address

- item sales tax group

-

A customer uses the sales tax functionality in Dynamics 365 Finance.

The customer reports that when a sales order is created, sales tax does not calculate on the line.

You need to determine why sales tax is not calculated.

What are two possible reasons? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- The sales tax group is populated on the line, but the item sales tax group is missing.

- The sales tax settlement account is not configured correctly.

- The sales tax authority is not set up for the correct jurisdiction.

- The sales tax code and item sales tax code are selected, but the sales tax group is not associated to both codes.

- The sales tax group and item sales tax group are selected, but the sales tax code is not associated with both groups.

-

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

USMF recently opened a new bank account in the Brazilian currency.

You need to create a new bank account in the system for the new bank account.

To complete this task, sign in to the Dynamics 365 portal.

- See explanation below.

Explanation:

1. Create a new bank account at Cash and bank management > Bank accounts > Bank accounts.

2. Complete all required fields. The following list includes some fields that might be required.

– Bank account (code)

– Bank account number

– Main account – This is the general ledger account that is used for posting.

– Currency

– SWIFT code

3. Enter Brazil-specific information:

– Select Bank in the Bank groups field. Confirm that the BIC and Corr. Bank account fields are correct. Also, confirm Address and Contact information on respective Fast Tabs and update accordingly.

– Define the number series for payment order generation in the P/O numeration field.

– For bank accounts in foreign currency, you can also define .docx templates for generation of payment orders in paper format in the following fields: Payment order in currency, Order template (currency sale), and Order template (currency purchase). -

A client needs guidance on month-end closing procedures.

The client needs to be able to stop all teams except Accounts payable and General ledger from posting transactions for the month.

You need to configure Dynamics 365 Finance to allow only those two teams to transact during the period being closed.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Create an access group called month end access for Accounts payable and General ledger team members.

- Set all modules to none to prevent any transactions from being posted.

- Configure the financial period close workspace tasks to the Accounts payable and General ledger teams only

- Move the period status to on hold for your client’s one legal entity.

- Assign the security group month end access on the ledger calendar form for the modules they need access to.

-

An organization is upgrading to Dynamics 365 Finance.

One of the organization’s legal entities needs to have different main accounts for a period of six months.

You need to configure the legal entity override dates.

Which two actions can you perform? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- Set the value of the override date field at the legal entity level to be more restrictive.

- Set the value of the override date field at the shared level to be more restrictive.

- Set the value of the override date field at the legal level to be less restrictive.

- Set the value of the override date field at the shared level to be less restrictive.

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions.

The client has the following requirements:

– Only expense accounts require dimensions posted with the transactions.

– Users must not have the option to select dimensions for a balance sheet account.You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry.

Solution: Configure default financial dimensions on expense accounts only.

Does the solution meet the goal?

- Yes

- No