MB-310 : Microsoft Dynamics 365 Finance : Part 03

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions.

The client has the following requirements:

– Only expense accounts require dimensions posted with the transactions.

– Users must not have the option to select dimensions for a balance sheet account.You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry.

Solution: Configure two account structures: one for expense accounts and include applicable dimensions, and one for balance sheet and exclude financial dimensions.

Does the solution meet the goal?

- Yes

- No

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions.

The client has the following requirements:

– Only expense accounts require dimensions posted with the transactions.

– Users must not have the option to select dimensions for a balance sheet account.You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry.

Solution: Configure one account structure for expense accounts and apply advanced rules.

Does the solution meet the goal?

- Yes

- No

-

DRAG DROP

A customer implements Dynamics 365 Finance.

The customer observes that during foreign currency revaluation of the Accounts Receivable subledger, the results are not as expected.

You need to re-run the foreign currency revaluation of the Accounts Receivable subledger.

Which currency revaluation method should you use for each requirement? To answer, drag the appropriate methods to the correct requirements. Each method may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q03 014 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q03 014 Answer -

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution. Determine whether the solution meets the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A customer uses Dynamics 365 Finance.

The controller notices incorrect postings to the ledger entered via journal.

The system must enforce the following:

– Expense accounts (6000-6998) require department, division, and project with all transactions. Customer dimension is optional.

– Revenue accounts (4000-4999) require department and division and allow project and customer dimensions.

– Liability accounts (2000-2999) should not have any dimensions posted.

– Expense account (6999) requires department, division, project and customer dimensions with all transactions.You need to configure the account structure to meet the requirements.

Solution:

– Configure one account structure.

– Configure an advanced rule for Liability accounts (2000-2999) not to display any dimensions when selected.

– Configure an advanced rule for Expense account (6999) to require customer.

– Configure the structure with all dimension fields containing quotations.Does the solution meet the goal?

- Yes

- No

Explanation:

Dimension fields containing quotations means that a blank value is accepted. This does not enforce a value being configured for the dimensions that are ‘Required’. -

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution. Determine whether the solution meets the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A customer uses Dynamics 365 Finance.

The controller notices incorrect postings to the ledger entered via journal.

The system must enforce the following:

– Expense accounts (6000-6998) require department, division, and project with all transactions. Customer dimension is optional.

– Revenue accounts (4000-4999) require department and division and allow project and customer dimensions.

– Liability accounts (2000-2999) should not have any dimensions posted.

– Expense account (6999) requires department, division, project and customer dimensions with all transactions.You need to configure the account structure to meet the requirements.

Solution:

– Configure two account structures: one for liability accounts listing the (2000-2999) range with no following dimensions and one for Expense and Revenue accounts.

– For Expense accounts (6000-6998) and Revenue accounts (4000-4999), configure asterisks in all dimension columns.

– For Expense account (6999), configure asterisks in all dimensions. Configure an asterisk and quotes in the customer dimension.Does the solution meet the goal?

- Yes

- No

Explanation:

As asterisk in all dimension columns would mean that a value must be configured for all dimensions. -

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution. Determine whether the solution meets the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A customer uses Dynamics 365 Finance.

The controller notices incorrect postings to the ledger entered via journal.

The system must enforce the following:

– Expense accounts (6000-6998) require department, division, and project with all transactions. Customer dimension is optional.

– Revenue accounts (4000-4999) require department and division and allow project and customer dimensions.

– Liability accounts (2000-2999) should not have any dimensions posted.

– Expense account (6999) requires department, division, project and customer dimensions with all transactions.You need to configure the account structure to meet the requirements.

Solution:

– Configure one account structure with department, division, project and customer dimensions.

– Configure asterisks in all columns for Expense accounts (6000-6999), Revenue accounts (4000-4999), and Liability accounts (2000-2999).Does the solution meet the goal?

- Yes

- No

Explanation:

As asterisk in all dimension columns would mean that a value must be configured for all dimensions. -

Case study

This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question.

Background

Fourth Coffee is a coffee and supplies manufacturer based in Seattle. The company recently purchased Company A, based in the United States, and Company B, based in Canada, in order to increase production of their award-winning espresso machine and distribution of their dark roast coffee beans, respectively.

Fourth Coffee has set up Company A and Company B in their Dynamics 365 Finance and Operations environment to gain better visibility into the companies’ profitability. Company A and Company B will continue to operate as subsidiaries of Fourth Coffee, but all operational companies will be consolidated under Fourth Coffee Holding Company in US dollars (USD) for reporting purposes.

The current organizational chart is shown below:

MB-310 Microsoft Dynamics 365 Finance Part 03 Q07 015 Current environment

Systemwide setup

– Dynamics 365 Finance in Microsoft Azure is used to manage the supply chain, retail, and financials.

– All companies share a Chart of Accounts.

– Two dimensions are used: Department and Division.

– Budgeting is controlled at the department level.

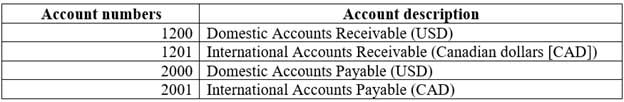

– Customers and vendors are defined as two groups: Domestic and International.

– Mandatory credit check is set to No.

– Consolidate online is used for the consolidation of all companies.

– International main accounts are subject to foreign currency revaluation.

– The purchasing budget is used to enforce purchasing limits.General ledger accounts

MB-310 Microsoft Dynamics 365 Finance Part 03 Q07 016 Fourth Coffee

– The base currency is USD.

– Three item groups are used: coffee, supplies, and nonstock.

– The standard sales tax method is used.

– Acquiring fixed assets requires a purchase order.

– All customer payment journals require a deposit slip.

– Customer X is a taxable company.

– Customer Y is a tax-exempt company.

– Customer Z is a taxable company.

– Vendor A is a Colombian supplier of coffee beans and belongs to the international vendor group.

– Vendor B is a Peruvian supplier of coffee machine filters and belongs to the international vendor group.

– Vendor C is a Texas supplier of espresso valves and belongs to the domestic vendor group.Company A

– The base currency is USD.

– It consists of a marketing department and a digital division.

– A 4-5-4 calendar structure is used.

– The standard sales tax method is used.Company B

– The base currency is CAD.

– The conditional sales tax method is used.Requirements

Reporting

– A consolidated Fourth Coffee financial report is required in USD currency.

– Fourth Coffee and its subsidiaries need to be able to report sales by item type.

– Year-end adjustments need to be reported separately in a different period to view financial reporting inclusive and exclusive of year-end adjustments.Issues

– User1 observes that a General journal was used in error to post to the Domestic Accounts Receivable trade account.

– User2 has to repeatedly reclassify vendor invoice journals in Fourth Coffee Company that are posted to the marketing department and digital division.

– When User3 posts an Accounts receivable payment journal, a deposit slip is not generated.

– User4 observes an increase in procurement department expenses for supplies.

– User5 observes that sales tax is not calculating on a sales order for Customer Z.

– User6 observes that sales tax is calculating for Customer Y.

– User7 observes that the sales tax payment report is excluding posted invoice transactions.

– User8 in Company A attempts to set up the sales tax receivable account on the sales tax posting form.

– User9 in Company A needs to purchase three tablets by using a purchase order and record the devices as fixed assets.

– Customer X requires a credit check when making a purchase and is currently at their credit limit.-

HOTSPOT

You need to configure settings to resolve User1’s issue.

Which settings should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q07 017 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q07 017 Answer -

You need to correct the sales tax setup to resolve User5’s issue.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Populate the sales tax code on the sales order line.

- Assign the sales tax group to Customer Y.

- Assign the relevant sales tax code to both the sales tax and item sales tax groups.

- Populate the item sales tax group field on the sales order line.

- Populate the sales tax group field on the sales order line.

-

You need to troubleshoot the reporting issue for User7.

Why are some transactions being excluded?

- User7 is running the report in Company B.

- User7 is running the report in Company A.

- The report is correctly excluding Customer Y transactions.

- The report is correctly excluding Customer Z transactions.

-

You need to configure settings to resolve User8’s issue.

What should you select?

- a main account in the sales tax payable field

- a main account in the settlement account field

- the Conditional sales tax checkbox

- the Standard sales tax checkbox

-

DRAG DROP

You need to assist User3 with generating a deposit slip to meet Fourth Coffee’s requirement.

Which five actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q07 018 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q07 018 Answer -

You need to view the results of Fourth Coffee Holding Company’s consolidation.

Which three places show the results of financial consolidation? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- a financial report run against the company Fourth Coffee

- a trial balance in the Fourth Coffee Holding Company

- a trial balance in the company Fourth Coffee

- a financial report run against the Fourth Coffee Holding Company

- the consolidations form in Fourth Coffee Holding Company

-

You need to configure the system to resolve User8’s issue.

What should you select?

- the Standard sales tax checkbox

- the Conditional sales tax checkbox

- a main account in the settlement account field

- a main account in the sales tax payable field

-

-

Case study

This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question.

Background

Munson’s Pickles and Preserves Farm grows and distributes produce, jellies, and jams. The company’s corporate headquarters is located in Dallas, TX. Munson’s has one operations center and seven regional distribution centers in the United States.

The company has two wholly owned subsidiaries that operate in Canada. The Canadian entity owns an entity in France.

Munson’s plans to expand into Latin America by purchasing the last 25 percent of a subsidiary that they own in Costa Rica. This process is expected to complete within the next two years.

The company plans to implement Dynamics 365 Finance and Dynamics 365 Supply Chain to meet their growing business needs.

Current environment. General

Munson’s uses a mix of internally-developed legacy systems that handle their finance and distribution activities. The company has an isolated CRM system.

– Both Canadian subsidiaries have two departments: marketing and operations.

– Financial reporting is difficult due to data residing in disparate systems.

– Financial reporting is currently performed by using Microsoft Excel.

– Pre-orders in the current system are difficult to track because the order management system is not integrated with the finance system.

– Pickle sales post to one revenue account, but this does not allow for targeted reporting by pickle cut and type.Current environment. Organization

The following chart shows Accounting/Reporting Currencies and Tax ID, if applicable.

– Typically, vendor invoices are received prior to receipt of product.

– The following fixed assets are sold for a loss:

1. BUILD-100

2. CAR-1233

– At the regional distribution centers, the value for physical inventory does not match the inventory in the financial system.

– Munson’s rents their corporate office. Rent is not paid by purchase order. Rent is due once a quarter.

– Allocations are performed manually.

– Barrels are inventoried by site and warehouse.

– Munson’s has multiple depreciation and tax books for all of their fixed asset equipment.

– Budgets are posted at the department level for each legal entity.Requirements. Sales

– Customers should be able to pre-order for fall release of pickles.

– Three-way matching must be enforced for all purchases.

– Fixed asset sale transactions require a ledger account entered at the time of transaction.

– Fixed assets purchased must be automatically created in fixed asset module. This includes inventory items and write in purchase orders/non-inventoried items.

– One dollar from every sale needs must be tracked and donated at the end of each month to a charitable organization.

– Purchasing budgets must be enforced at the main account level.Requirements. Finances

– Accounts payable must be able to enter vendor invoices on the day they were received to be settled against when product is received.

– Accounts payable must be able to enter vendor invoices to accrue expense without specifying a purchase order at the time of entry.

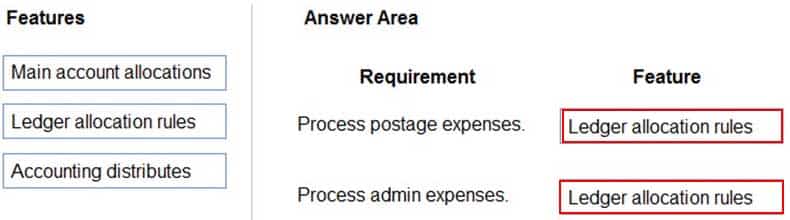

– Postage expenses must be split evenly across the regional distribution centers automatically.

– Administrative expenses must be distributed across the regional distribution centers by percentage of fulfillment orders monthly.

Pickling machines depreciation must be uniquely recorded for visibility but not post to the ledger.Issues

– During implementation testing, User1 indicates that after packing slips are generated for purchase orders, there are no ledger postings.

– User2 indicates that fixed assets purchased on a purchase order do not show up in the Fixed Assets module.

– User3 reports that they are seeing inconsistent application of the one-dollar donation from all sales orders.

– User4 in the Canadian subsidiary is able to purchase supplies for marketing despite exceeding the marketing department budget.

– User5 reports that when purchasing a non-inventoried computer, the system is automatically assigning it to the buildings fixed asset group.-

HOTSPOT

You need to determine the root cause for User1’s issue.

Which configuration options should you check? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q08 019 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q08 019 Answer -

DRAG DROP

You need to process expense allocations.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q08 020 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q08 020 Answer -

You need to configure system functionality for pickle type reporting.

What should you use?

- item model groups

- item groups

- procurement category hierarchies

- financial dimensions

- procurement categories

-

-

Case study

This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question.

Background

Alpine Ski House has three partially owned franchises and 10 fully owned resorts throughout the United States and Canada. Alpine Ski House’s percentage ownership of the franchises is between two and 10 percent.

Alpine Ski House is undergoing an implementation of Dynamics 365 Finance and Dynamics 365 Supply Chain Management to transform their financial management and logistics capabilities across the franchises. Implementation is complete for Alpine Ski House’s corporate offices, two US franchises, and one Canadian franchise. The remaining franchises are in varying stages of the implementation. Two new resort projects are in the budget planning stages and will open in the next fiscal year.

Current environment

Organization and general ledger

– Each franchise is set up as a legal entity in Dynamics 365 Finance.

– Alpine Ski House Corporate uses financial dimensions for their fully owned resorts.

– Each resort is a financial dimension named resort.

– Each fully owned resort has two divisions: marketing and operations.

– Only Profit and Loss account postings require the division dimension.

– Corporate handles the advertising and administration of the fully owned resorts.

– Corporate uses Dynamics 365 Project Management and Accounting to manage construction of new resorts.Budgeting

– Organizational budgeting is decentralized but rolls up to one organizational corporate budget.

– Each resort manager performs budgeting in Dynamics 365 Finance.

– Budget preparation begins this month. All operational resorts will submit their budgets in two weeks.Sales and tax

– Sales tax is configured and used by all resorts that operate in the United States.

– You configure one US sales tax vendor account and assign the vendor account to the settlement periods for reporting.

– You use accounts receivable charges to track donations.Existing purchasing contracts

– Each franchise resort has an individual contract with a local supplier of their choosing to purchase at least $10,000 worth of suppliers during the calendar year.

– The franchise resorts in one US state receive a two percent discount on meat and vegetable purchases in excess of $8,000 per year.

– A franchise resort in Utah has agreed to purchase 1,000 units of beef at market price from a local supplier.

– Alpine Ski House uses a vendor collaboration portal to track purchase orders and requests for quotes.

– Vendors request access to the vendor collaboration portal by using a workflow which runs on a nightly schedule.Intercompany setup

– Vendor123 resides in US franchise Company1 and is set up for intercompany transactions. – Customer345 resides in Canada franchise Company1 and is set up for intercompany transactions.

Requirements

Franchises

– Each franchise must pay two percent of monthly sales to Alpine Ski House Corporate.

– Each franchise must report their own financials to Alpine Ski House Corporate monthly.

– US franchises require a three-way-match on all purchases, with a 1-percent price tolerance.

– Canadian franchises require a three-way-match on all purchases except paper products, which have a 10-percent price tolerance.Corporate

– Advertising costs must be balanced across the 10 resorts monthly. These costs must be split across the 12 resorts once construction of the final two resorts is completed.

– Administration costs must be split across the 10 resorts proportional to the amount of sales generated.

– One percent of all pack and individual ski pass sales must be donated quarterly to an environmental protection organization.

– The finance department must be able to see purchasing contracts and discounts for vendors based on volume spend.Employees

All employee expense reports that contain the word entertainment must be reviewed for audit purposes. If a journal is posted incorrectly, the entire journal and not just the incorrect line must be fully reversed for audit purposes.

Resorts

All resorts must use Dynamics 365 Finance for budgeting and must first be approved by the regional manager. Purchased fixed assets must automatically be acquired at product receipt.

Issues

– User1 reports that irrelevant dimensions display in the drop down when entering a General journal.

– User2 reports that dimension 00 is being used for all balance sheet accounts.

– User3 tries to generate the quarterly sales tax liability payment for a specific state but does not see any payables available for that state’s vendor.

– User4 receives a call from a vendor who cannot access the vendor collaboration portal but needs immediate access.

– User5 notices a large amount of entertainment expenses being posted without an audit review.

– User6 needs to have visibility into the increase in budget that is necessary to staff the two new resorts opening next year.

– User7 needs to use Dynamics 365 Finance for situational budgeting planning with the ability to increase and decrease the existing plans by certain percentages.

– User8 made a mistake while posting a 1,000-line journal and reverses the entire journal but cannot find the lines that included errors during the reversal.

– User9 made a mistake while posting a 55-line journal and reverses the entire journal.

– User10 realizes that the purchase of five new computers did not acquire five new fixed assets upon receipt.-

The Canadian franchise purchases excess ski equipment from the US franchise. Two sets of skis are purchased totaling USD1,000.

When the purchase invoice is prepared, USD10,000 is keyed in by mistake.

Which configuration determines the result for this intercompany trade scenario?

- Post invoices with discrepancies is set to require approval.

- Match invoice totals is set to yes.

- Three-way match policy is configured.

- Two-way match policy is configured.

- Post invoices with discrepancies is set to allow with warning.

-

DRAG DROP

You need to configure ledger allocations to meet the requirements.

What should you configure? To answer, drag the appropriate setups to the correct requirements. Each setup may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q09 021 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q09 021 Answer -

You need to adjust the sales tax configuration to resolve the issue for User3.

What should you do?

- Create multiple settlement periods and assign them to the US tax vendor.

- Create multiple sales tax remittance vendors and assign them to the settlement period.

- Run the payment proposal to generate the sales tax liability payments.

- Create a state-specific settlement period and assign the US tax vendor to the settlement period.

-

-

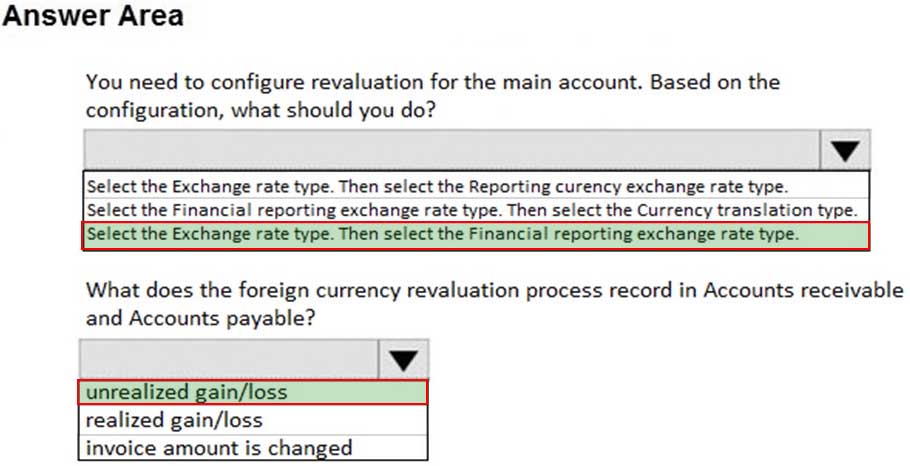

HOTSPOT

You are asked to configure foreign currency revaluation in Dynamics 365 Finance.

You are viewing the main accounts.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q10 022 Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q10 022 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q10 022 Answer -

DRAG DROP

You are a consultant who is implementing Dynamics 365 Finance in your organization.

You need to set up currencies and exchange rates for a client.

Which three actions should you perform in sequence? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q11 023 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q11 023 Answer -

HOTSPOT

You need to set up legal entity currencies and conversions in Dynamics 365 Finance.

You review the hierarchy for consolidation of multiple legal entities.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q12 024 Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q12 025 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q12 025 Answer -

You are configuring account structures and advanced rules in Dynamics 365 Finance.

All balance sheet accounts require Business Unit and Department dimensions.

The Shareholder distribution account requires an additional dimension for Principal.

You need to set up the account structures.

What are two possible ways to achieve the goal? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- Create a new main account for each of the company’s principals. Then, create an account structure for all balance sheet accounts that includes the required dimension.

- Create a new main account for Shareholder distribution. Add an advanced rule for the Principal dimension.

- Create an account structure for all the balance sheet accounts. Set up an advanced rule for the Shareholder distribution account for the Principal dimension.

- Create an account structure for balance sheet accounts without Shareholder distribution. Then, create a second account structure for Shareholder distribution that includes all required dimensions.

-

A client uses the standard trial balance in Dynamics 365 Finance.

The client has the following requirements:

– ability to run the trial balance by main account, department, and division

– ability to run the trial balance by just main account and departmentYou need to ensure that these options are visible in the trial balance report parameters.

What should you configure?

- ledger validation

- financial dimensions for department and division

- financial dimension sets

- account structure

-

SIMULATION

You are a functional consultant for a legal entity named Contoso Group (GLCO).

You plan to sell new products that will increase in quality over time.

You need to implement a solution that uses the Last in, First out (LIFO) inventory model for GLCO.

To complete this task, sign in to the Dynamics 365 portal.

- See explanation below.

Explanation:You need to configure an Inventory Model Group for the new products.

1. For inventory model groups, navigate to Inventory management | Setup | Inventory | Item model groups.

2. Click “New” to create a new inventory model group.

3. In the “Cost method and cost recognition” section, configure the “Inventory Model” setting to Last in, First out (LIFO).

4. Click “Save” to save the inventory model group. -

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to generate a trial balance report for the period of January 1, 2017 to December 31, 2017. To validate you results, save the file in Microsoft Excel format to the Downloads\Trial folder.

To complete this task, sign in to the Dynamics 365 portal.

- See explanation below.

Explanation:1. Click General ledger > Reports > Transactions > Trial Balance

2. Enter the Start and End dates for the report.

3. Click Destinations … to specify how you want to ‘print’ the report.

4. Select File as the destination.

5. Select the Downloads\Trial folder for the location.

6. Select Microsoft Excel for the file format.

7. Click OK to close the ‘Print destination settings’ form.

8. Click OK to ‘print’ (save) the report to the selected destination. -

DRAG DROP

A client plans to use financial statements in Dynamics 365 Finance. The client wants to process the statements by using various combinations of the components to create custom reports.

You need to associate the report components to the purpose.

Which report components should you use for each purpose? To answer, drag the appropriate component to the correct purpose. Each component may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q17 026 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q17 026 Answer -

HOTSPOT

You are setting up main accounts in Dynamics 365 Finance.

You need to configure the main accounts to meet the requirements.

Which options should you use? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q18 027 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q18 027 Answer -

HOTSPOT

You are setting up the process for an expense report approval in Dynamics 365 Finance.

You need to assign permission for each participant in the workflow approval process to perform their tasks.

Which action can each participant perform? To answer, select the appropriate option in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 03 Q19 028 Question

MB-310 Microsoft Dynamics 365 Finance Part 03 Q19 028 Answer -

A client has one legal entity and the following four dimensions configured: Business Unit, Cost Center, Department, and Division.

You need to configure the client’s system to run the trial balance inquiry in the General ledger module so that it displays the trial balance two ways:

– Include the main account and all four dimensions.

– Include the main account and only the business unit and cost center dimensions.What should you configure?

- two account structures

- two derived financial dimension hierarchies

- all financial dimensions by using the group dimension functionality

- two financial dimension sets