MB-310 : Microsoft Dynamics 365 Finance : Part 04

-

You are configuring intercompany accounting for a multi company enterprise.

You need to set up the Due to and Due from accounts.

Which main account type should you use?

- Profit and loss

- Expense

- Balance sheet

- Liability

- Asset

-

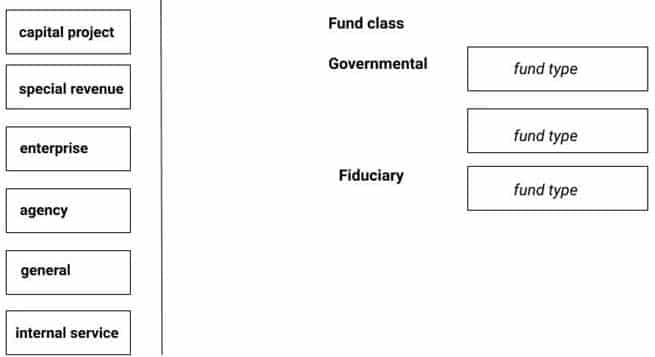

DRAG DROP

You are controller for a public sector organization. You need detailed fiscal tracking and reporting.

You need to set up fund types categorized under specific fund classes.

Which fund type can you set up for each fund class? To answer, drag the appropriate fund types to the correct fund classes. Each fund type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q02 029 Question

MB-310 Microsoft Dynamics 365 Finance Part 04 Q02 029 Answer -

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has multiple legal entities set up in Dynamics 365 Finance. All companies and data reside in Dynamics 365 Finance.

The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to use Dynamics 365 Finance instead.

You need to configure the system and correctly perform eliminations.

Solution: Select Consolidate online in Dynamics 365 Finance. Include eliminations during the process or as a proposal. Set up the transactions to post in the legal entity configured for consolidations.

Does the solution meet the goal?

- Yes

- No

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has multiple legal entities set up in Dynamics 365 Finance. All companies and data reside in Dynamics 365 Finance.

The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to use Dynamics 365 Finance instead.

You need to configure the system and correctly perform eliminations.

Solution: Select Consolidate with import.

Does the solution meet the goal?

- Yes

- No

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has multiple legal entities set up in Dynamics 365 Finance. All companies and data reside in Dynamics 365 Finance.

The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to use Dynamics 365 Finance instead.

You need to configure the system and correctly perform eliminations.

Solution: Create a separate company in which you manually create the eliminations. Then, use that company in financial reporting or in the consolidation process.

Does the solution meet the goal?

- Yes

- No

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has multiple legal entities set up in Dynamics 365 Finance. All companies and data reside in Dynamics 365 Finance.

The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to use Dynamics 365 Finance instead.

You need to configure the system and correctly perform eliminations.

Solution: Set up Elimination rules in the system. Then, run an elimination proposal. Configure the rules to post to any company that has Use for financial elimination process selected in the legal entity setup.

Does the solution meet the goal?

- Yes

- No

-

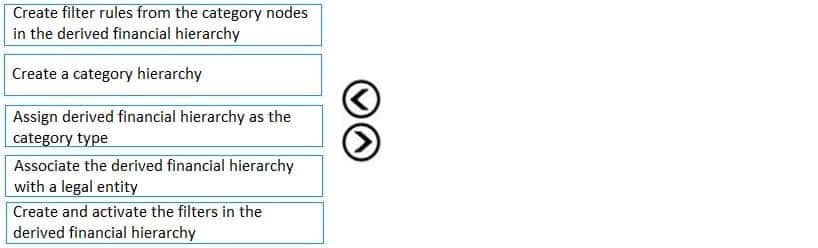

DRAG DROP

A public sector organization wants to set up the derived financial hierarchy to analyze posted transaction data.

You need to set up the derived financial hierarchy to generate an outgoing electronic document.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q07 030 Question

MB-310 Microsoft Dynamics 365 Finance Part 04 Q07 030 Answer -

You work for a company that receives invoices in foreign currencies.

You need to configure the currency exchange rate providers and exchange rate types.

What should you do?

- Configure exchange rate provider, create exchange rate type, and import the currency exchange rates.

- Select the appropriate HTML key values from the available exchange rate providers. Then, use the provider for importing one currency exchange rate type.

- Use a developer to write the HTML key values code to configure the currency exchange rate providers. Then, use the provider for importing a currency exchange rate type.

- Use a developer to write the XML key values code to configure the currency exchange rate providers. Then, use the provider for importing a currency exchange rate type.

-

Users are posting project transactions and bank transactions incorrectly in the General journal. The client wants to prevent this from happening in the future.

You need to configure Dynamics 365 Finance to limit the account type transactions to only ledger.

What should you do?

- Use journal control to specify which account types are valid for the General ledger journal.

- Use advanced ledger entries to define the account types that can be used in the General ledger journal.

- Configure the voucher series associated with this journal to allow only ledger account types.

- Create a journal template that has ledger as the account type and offset account type.

-

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

You plan to settle accounts by receiving cash payments in US currency.

You need to create a cash receipts journal that uses the US dollar currency.

To complete this task, sign in to the Dynamics 365 portal.

- See explanation below.

Explanation:1. Navigate to Finance > Cash Receipt Journals.

2. Click the +New link to add a new cash receipt journal.

3. Fill in the required fields including the currency field. -

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to apply a constant currency exchange rate to calculate the reporting currency value of fixed assets.

To complete this task, sign in to the Dynamics 365 portal.

- See explanation below.

Explanation:The currency Translation Type needs to be set to Current. This option uses the last rate on or before the period specified in the report regardless of what the exchange rate was at the time of purchase for each asset.

1. Navigate to General Ledger > Chart of Accounts > Accounts > Main Accounts.

2. Select the Financial Reporting account.

3. In the Reporting currency exchange rate type, select Current from the drop-down list.

4. Click Save to save the changes. -

An organization plans to use defined journal names for each purpose. They want to ensure that journal processing is easier and more secure.

The organization has the following requirements:

– Set up restrictions on the account type and segment values.

– Capture data accurately for offset accounts, currency, and financial dimensions.

– Maintain internal control and establish materiality limits.You need to set up journal name elements to meet these requirements.

Which three journal elements should you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- workflow approval

- account type

- journal type

- default values

- journal control

-

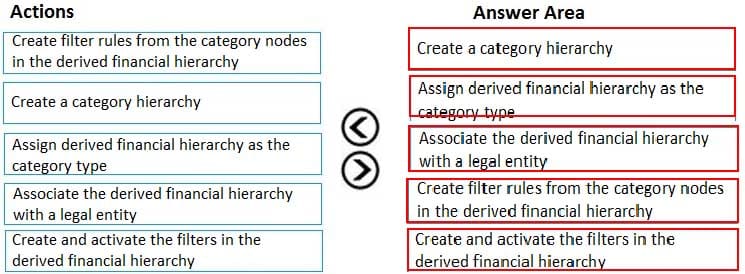

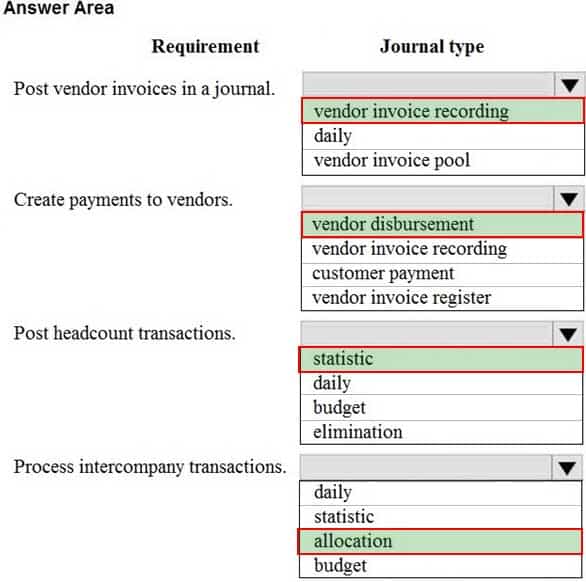

HOTSPOT

You plan to implement Dynamics 365 Finance.

You need to configure the system to meet the following requirements:

– Post vendor invoices in a journal.

– Create payments to vendors.

– Post headcount transactions.

– Process intercompany transactions.Which journal types should you use? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q13 031 Question

MB-310 Microsoft Dynamics 365 Finance Part 04 Q13 031 Answer -

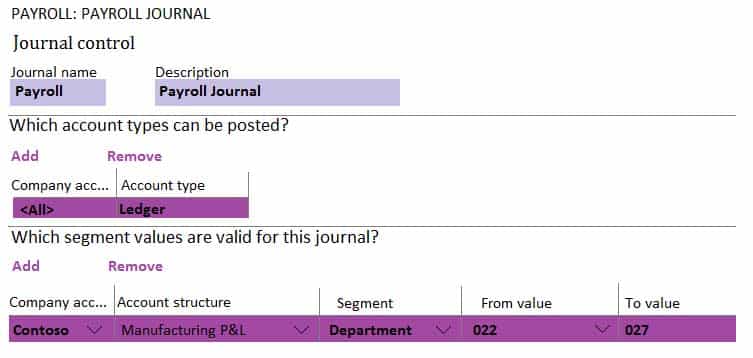

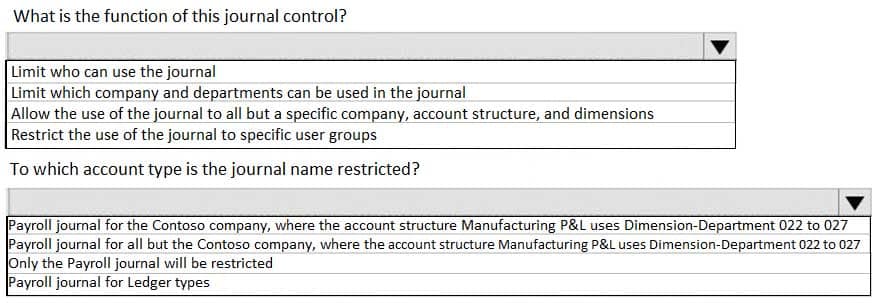

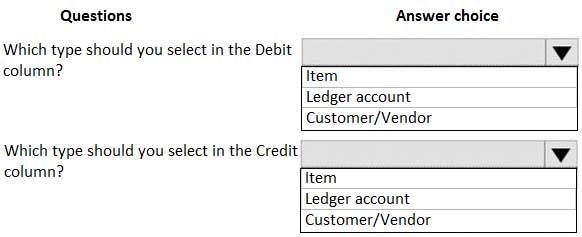

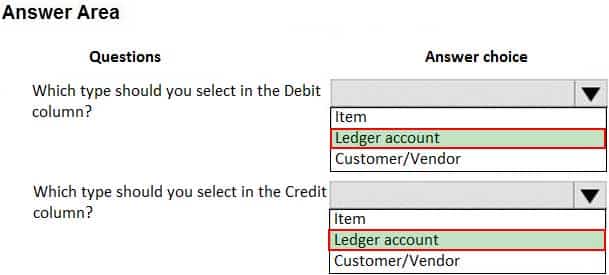

HOTSPOT

You must configure journal controls in Dynamics 365 Finance.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q14 032 Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q14 033 Question

MB-310 Microsoft Dynamics 365 Finance Part 04 Q14 033 Answer -

HOTSPOT

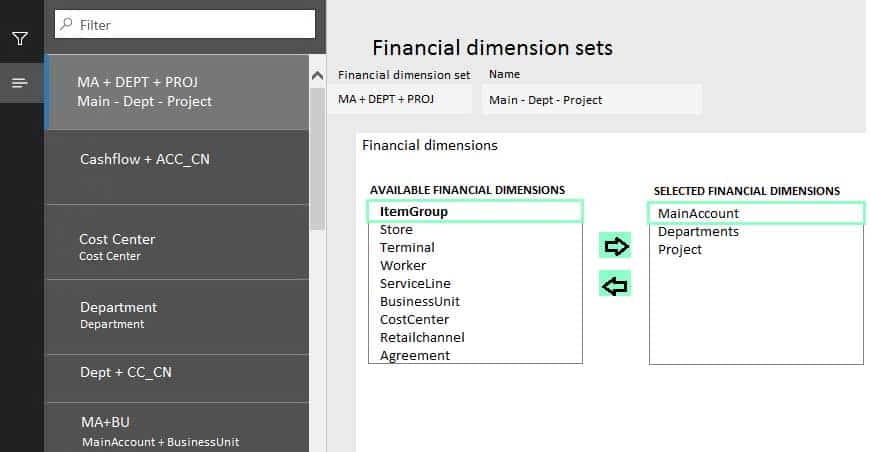

You create a financial dimension set named MA + DEPT + PROJ as shown in the following screenshot. The financial dimension set includes the following dimensions:

– Main Account

– Department

– Project

MB-310 Microsoft Dynamics 365 Finance Part 04 Q15 034 Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q15 035 Question

MB-310 Microsoft Dynamics 365 Finance Part 04 Q15 035 Answer -

DRAG DROP

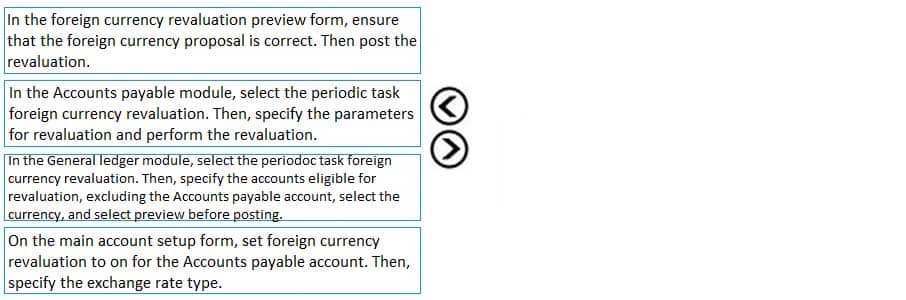

A client has Accounts payable invoices in their legal entity in three different currencies. It is month-end, and the client needs to run the foreign currency revaluation process to correctly understand their currency exposure.

You need to set up Dynamics 365 Finance to perform foreign currency revaluation.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q16 036 Question

MB-310 Microsoft Dynamics 365 Finance Part 04 Q16 036 Answer -

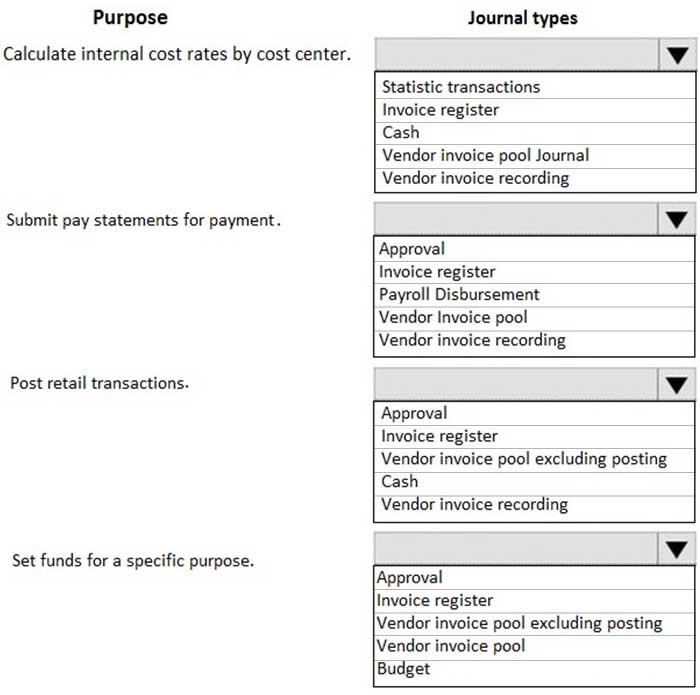

HOTSPOT

A company is using vendors to produce components for its products.

Journal types are not configured to support vendor invoices.

You need to identify and configure journals to use for vendor invoices.

Which journal types should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q17 037 Question

MB-310 Microsoft Dynamics 365 Finance Part 04 Q17 037 Answer -

A client is implementing Accounts payable. The client wants to establish three-way matching for 100 of their 5,000 stocked items from a specific vendor.

The client requires the ability to have items that require only two-way matching and specific items that require three-way matching.

You need to configure the system in the most efficient manner to achieve these requirements.

What should you do?

- Configure a company matching policy of a three-way match

- Configure a company matching policy of non-required and specify the items that require a three-way match

- Configure a company matching policy of two-way matching and set the matching policy for specific item and vendor combination level to three-way matching

- Configure a company matching policy of two-way matching and specify the items that require a three-way match

- Configure a company matching policy of two-way matching and specify the vendors that require a three-way match

-

DRAG DROP

A client observes that some customers are late paying their invoices. The client wants to use the Credit and Collections functionality to send collection letters to customers.

You need to configure the system to support collection letter functionality and processing.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q19 038 Question

MB-310 Microsoft Dynamics 365 Finance Part 04 Q19 038 Answer -

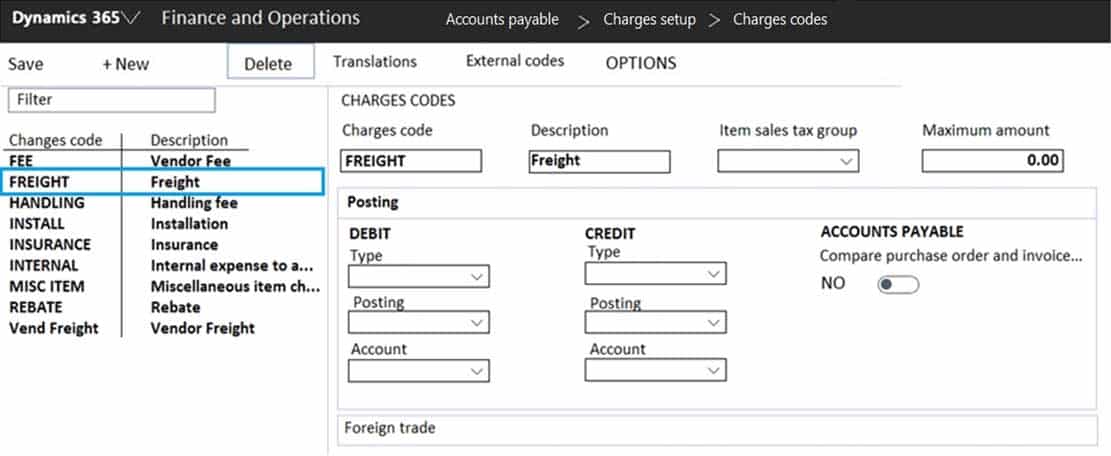

HOTSPOT

You need to configure an Accounts payable charge for freight for a company. The company requires that the system include the freight amount in the invoice to be paid to the vendor and record the expense in main account 600120 – Freight In.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q20 039 Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 04 Q20 040 Question

MB-310 Microsoft Dynamics 365 Finance Part 04 Q20 040 Answer