MB-310 : Microsoft Dynamics 365 Finance : Part 07

-

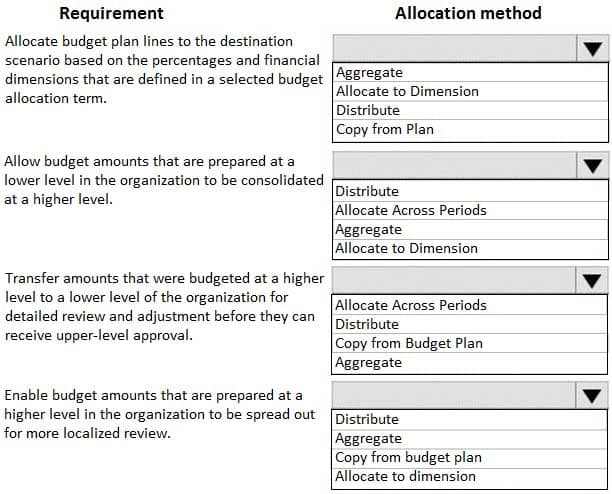

HOTSPOT

You are setting up a budget plan to accurately portray the projected budget for a company.

You need to select the appropriate allocation method for data distribution.

Which allocation methods should you use? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 07 Q01 073 Question

MB-310 Microsoft Dynamics 365 Finance Part 07 Q01 073 Answer -

A client is using the budget planning process in Dynamics 365 Finance.

Your client requires the ability to plan for a one-year, three-year, and five year-budget.

You need to configure the various year length options to be used in the budgeting module.

What should you do?

- Configure budget control

- Configure budget codes

- Configure budget cycles

- Configure budget allocation terms

-

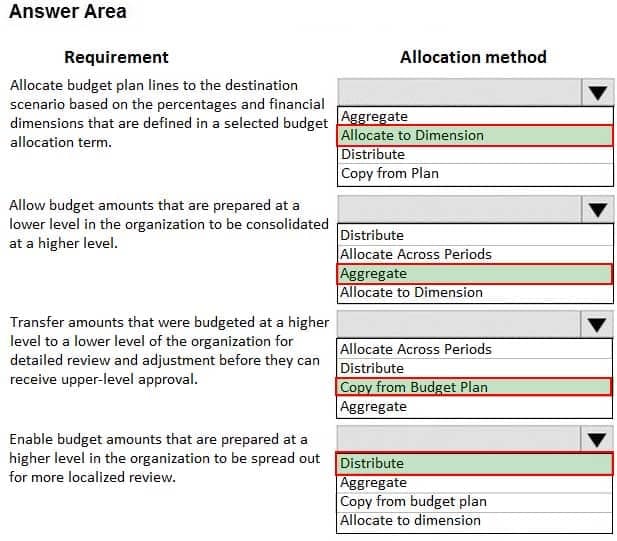

DRAG DROP

A company needs to create budget plan templates for its budgeting process.

You need to create the budget plan templates.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

MB-310 Microsoft Dynamics 365 Finance Part 07 Q03 074 Question

MB-310 Microsoft Dynamics 365 Finance Part 07 Q03 074 Answer -

A company uses Dynamics 365 Finance to manage budgets.

You need to reallocate funds during the year.

Which budget code should you use?

- Carry-forward

- Zero-based

- Pre-encumbrance

- Transfer

-

HOTSPOT

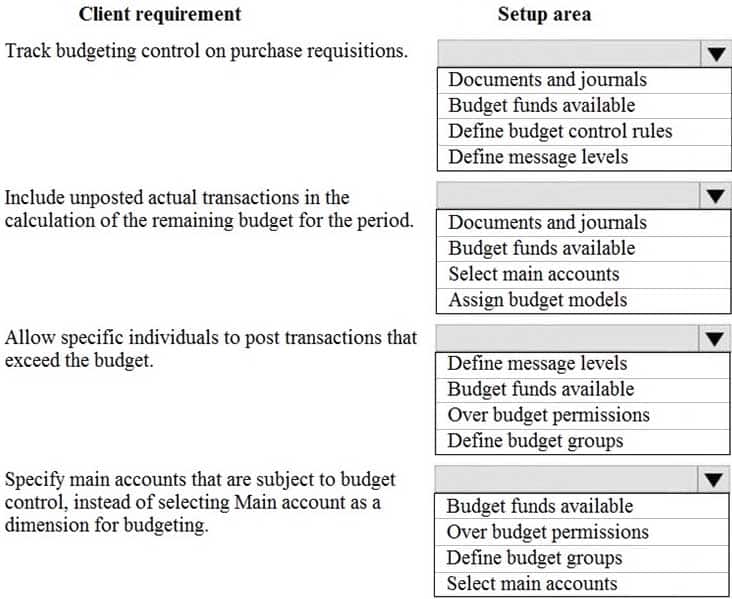

A client is implementing the Budgeting module in Dynamics 365 Finance.

You need to configure the correct budget control area to meet the client’s requirements.

– Track budgeting control on purchase requisitions.

– Include unposted actual transactions in the calculation of the remaining budget for the period.

– Allow specific individuals to post transactions that exceed the budget.

– Specify main accounts that are subject to budget control, instead of selecting Main account as a dimension for budgeting.What should you configure? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 07 Q05 075 Question

MB-310 Microsoft Dynamics 365 Finance Part 07 Q05 075 Answer -

A company plans to use Dynamics 365 Finance.

You need to configure basic budgeting.

Which set of actions must you perform?

- – Define a budget journal

– Define budgeting parameters

– Define budgeting dimensions

– Create budget models and codes

– Define number sequences - – Define budget journal exchange rate types

– Define budgeting parameters and number sequences

– Define budgeting dimensions

– Create budget models

– Define budget codes - – Define a budget journal

– Define budgeting parameters and number sequences

– Define budgeting dimensions

– Create budget models and codes

– Setup budget allocation terms - – Define budget exchange rate types

– Define budgeting parameters and number sequences

– Define financial dimensions

– Create budget models

– Define budget codes

- – Define a budget journal

-

You are configuring the Fixed assets module for a Dynamics 365 Finance environment.

You need to create a fixed asset.

Which two settings are required? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- the property type

- the group

- the number sequence

- the type

- the name

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A company is preparing to complete yearly budgets.

The company plans to use the Budget module in Dynamics 365 Finance for budget management.

You need to create the new budgets.

Solution: Create budget plans for multiple scenarios.

Does the solution meet the goal?

- Yes

- No

-

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A company is preparing to complete yearly budgets.

The company plans to use the Budget module in Dynamics 365 Finance for budget management.

You need to create the new budgets.

Solution: Create budget plans to define the revenues for a budget.

Does the solution meet the goal?

- Yes

- No

-

A customer uses Dynamics 365 Finance to manage budgets.

You review a customer’s budget funds available calculation and discover that the budget amounts posted two weeks ago are not reflected in the budget control check on a purchase order.

You verify that budget control is set to active.

You need to determine why the budget posted two weeks ago is not reflecting correctly.

What should you do?

- Verify that available budget funds are configured appropriately.

- Post a budget transfer to add the correct funds.

- Verify whether budget plans are still in draft status.

- Compare the budget control active date to the date of the posted register entries to verify that it was active at the time of posting.

-

Case study

This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question.

Background

Munson’s Pickles and Preserves Farm grows and distributes produce, jellies, and jams. The company’s corporate headquarters is located in Dallas, TX. Munson’s has one operations center and seven regional distribution centers in the United States.

The company has two wholly owned subsidiaries that operate in Canada. The Canadian entity owns an entity in France.

Munson’s plans to expand into Latin America by purchasing the last 25 percent of a subsidiary that they own in Costa Rica. This process is expected to complete within the next two years.

The company plans to implement Dynamics 365 Finance and Dynamics 365 Supply Chain to meet their growing business needs.

Current environment. General

Munson’s uses a mix of internally-developed legacy systems that handle their finance and distribution activities. The company has an isolated CRM system.

– Both Canadian subsidiaries have two departments: marketing and operations.

– Financial reporting is difficult due to data residing in disparate systems.

– Financial reporting is currently performed by using Microsoft Excel.

– Pre-orders in the current system are difficult to track because the order management system is not integrated with the finance system.

– Pickle sales post to one revenue account, but this does not allow for targeted reporting by pickle cut and type.Current environment. Organization

The following chart shows Accounting/Reporting Currencies and Tax ID, if applicable.

– Typically, vendor invoices are received prior to receipt of product.

– The following fixed assets are sold for a loss:

1. BUILD-100

2. CAR-1233

– At the regional distribution centers, the value for physical inventory does not match the inventory in the financial system.

– Munson’s rents their corporate office. Rent is not paid by purchase order. Rent is due once a quarter.

– Allocations are performed manually.

– Barrels are inventoried by site and warehouse.

– Munson’s has multiple depreciation and tax books for all of their fixed asset equipment.

– Budgets are posted at the department level for each legal entity.Requirements. Sales

– Customers should be able to pre-order for fall release of pickles.

– Three-way matching must be enforced for all purchases.

– Fixed asset sale transactions require a ledger account entered at the time of transaction.

– Fixed assets purchased must be automatically created in fixed asset module. This includes inventory items and write in purchase orders/non-inventoried items.

– One dollar from every sale needs must be tracked and donated at the end of each month to a charitable organization.

– Purchasing budgets must be enforced at the main account level.Requirements. Finances

– Accounts payable must be able to enter vendor invoices on the day they were received to be settled against when product is received.

– Accounts payable must be able to enter vendor invoices to accrue expense without specifying a purchase order at the time of entry.

– Postage expenses must be split evenly across the regional distribution centers automatically.

– Administrative expenses must be distributed across the regional distribution centers by percentage of fulfillment orders monthly.

– Pickling machines depreciation must be uniquely recorded for visibility but not post to the ledger.Issues

– During implementation testing, User1 indicates that after packing slips are generated for purchase orders, there are no ledger postings.

– User2 indicates that fixed assets purchased on a purchase order do not show up in the Fixed Assets module.

– User3 reports that they are seeing inconsistent application of the one-dollar donation from all sales orders.

– User4 in the Canadian subsidiary is able to purchase supplies for marketing despite exceeding the marketing department budget.

– User5 reports that when purchasing a non-inventoried computer, the system is automatically assigning it to the buildings fixed asset group.-

You need to identify the root cause for the error that User5 is experiencing.

What should you check?

- Fixed asset rules

- Fixed asset determination rules

- Fixed asset posting profiles

- Fixed asset books

- Fixed asset depreciation profiles

-

-

Case study

This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question.

Background

Alpine Ski House has three partially owned franchises and 10 fully owned resorts throughout the United States and Canada. Alpine Ski House’s percentage ownership of the franchises is between two and 10 percent.

Alpine Ski House is undergoing an implementation of Dynamics 365 Finance and Dynamics 365 Supply Chain Management to transform their financial management and logistics capabilities across the franchises. Implementation is complete for Alpine Ski House’s corporate offices, two US franchises, and one Canadian franchise. The remaining franchises are in varying stages of the implementation. Two new resort projects are in the budget planning stages and will open in the next fiscal year.

Current environment

Organization and general ledger

– Each franchise is set up as a legal entity in Dynamics 365 Finance.

– Alpine Ski House Corporate uses financial dimensions for their fully owned resorts.

– Each resort is a financial dimension named resort.

– Each fully owned resort has two divisions: marketing and operations.

– Only Profit and Loss account postings require the division dimension.

– Corporate handles the advertising and administration of the fully owned resorts.

– Corporate uses Dynamics 365 Project Management and Accounting to manage construction of new resorts.Budgeting

– Organizational budgeting is decentralized but rolls up to one organizational corporate budget.

– Each resort manager performs budgeting in Dynamics 365 Finance.

– Budget preparation begins this month. All operational resorts will submit their budgets in two weeks.Sales and tax

– Sales tax is configured and used by all resorts that operate in the United States.

– You configure one US sales tax vendor account and assign the vendor account to the settlement periods for reporting.

– You use accounts receivable charges to track donations.Existing purchasing contracts

– Each franchise resort has an individual contract with a local supplier of their choosing to purchase at least $10,000 worth of suppliers during the calendar year.

– The franchise resorts in one US state receive a two percent discount on meat and vegetable purchases in excess of $8,000 per year.

– A franchise resort in Utah has agreed to purchase 1,000 units of beef at market price from a local supplier.

– Alpine Ski House uses a vendor collaboration portal to track purchase orders and requests for quotes.

– Vendors request access to the vendor collaboration portal by using a workflow which runs on a nightly schedule.Intercompany setup

Vendor123 resides in US franchise Company1 and is set up for intercompany transactions. Customer345 resides in Canada franchise Company1 and is set up for intercompany transactions.

Requirements

Franchises

– Each franchise must pay two percent of monthly sales to Alpine Ski House Corporate.

– Each franchise must report their own financials to Alpine Ski House Corporate monthly.

– US franchises require a three-way-match on all purchases, with a 1-percent price tolerance.

– Canadian franchises require a three-way-match on all purchases except paper products, which have a 10-percent price tolerance.Corporate

– Advertising costs must be balanced across the 10 resorts monthly. These costs must be split across the 12 resorts once construction of the final two resorts is completed.

– Administration costs must be split across the 10 resorts proportional to the amount of sales generated.

– One percent of all pack and individual ski pass sales must be donated quarterly to an environmental protection organization.

– The finance department must be able to see purchasing contracts and discounts for vendors based on volume spend.Employees

All employee expense reports that contain the word entertainment must be reviewed for audit purposes. If a journal is posted incorrectly, the entire journal and not just the incorrect line must be fully reversed for audit purposes.

Resorts

All resorts must use Dynamics 365 Finance for budgeting and must first be approved by the regional manager. Purchased fixed assets must automatically be acquired at product receipt.

Issues

– User1 reports that irrelevant dimensions display in the drop down when entering a General journal.

– User2 reports that dimension 00 is being used for all balance sheet accounts.

– User3 tries to generate the quarterly sales tax liability payment for a specific state but does not see any payables available for that state’s vendor.

– User4 receives a call from a vendor who cannot access the vendor collaboration portal but needs immediate access.

– User5 notices a large amount of entertainment expenses being posted without an audit review.

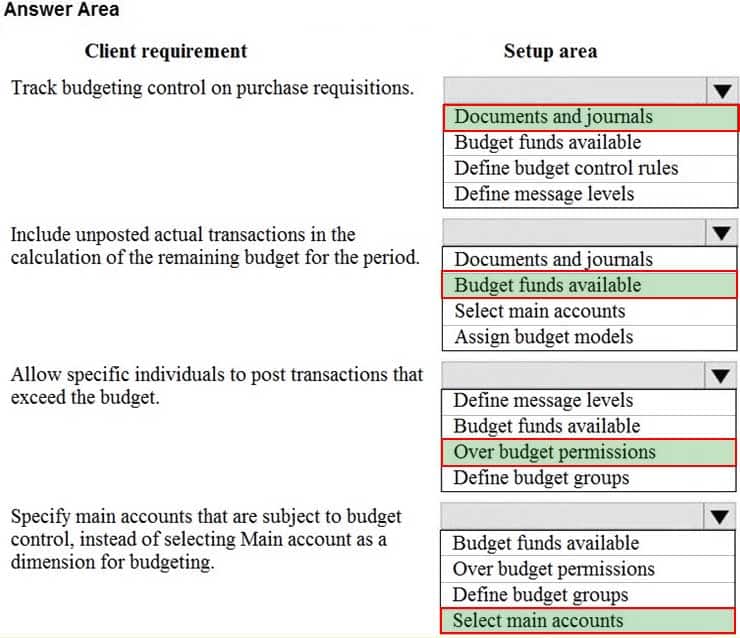

– User6 needs to have visibility into the increase in budget that is necessary to staff the two new resorts opening next year.

– User7 needs to use Dynamics 365 Finance for situational budgeting planning with the ability to increase and decrease the existing plans by certain percentages.

– User8 made a mistake while posting a 1,000-line journal and reverses the entire journal but cannot find the lines that included errors during the reversal.

– User9 made a mistake while posting a 55-line journal and reverses the entire journal.

– User10 realizes that the purchase of five new computers did not acquire five new fixed assets upon receipt.-

HOTSPOT

You need to configure the system to meet the budget preparation requirements.

What should you do? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-310 Microsoft Dynamics 365 Finance Part 07 Q12 076 Question

MB-310 Microsoft Dynamics 365 Finance Part 07 Q12 076 Answer -

You need to acquire the fixed assets that are associated with the purchase orders.

What should you do?

- Select the fixed asset checkbox on the invoice.

- Create the fixed assets in the fixed asset module and then acquire the asset.

- Create the fixed assets in the fixed asset module and then select the fixed asset checkbox on the product receipt.

- Reverse the product receipt and then repost it.

-

-

Case study

This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question.

Background

Fourth Coffee is a coffee and supplies manufacturer based in Seattle. The company recently purchased Company A, based in the United States, and Company B, based in Canada, in order to increase production of their award-winning espresso machine and distribution of their dark roast coffee beans, respectively.

Fourth Coffee has set up Company A and Company B in their Dynamics 365 Finance and Operations environment to gain better visibility into the companies’ profitability. Company A and Company B will continue to operate as subsidiaries of Fourth Coffee, but all operational companies will be consolidated under Fourth Coffee Holding Company in US dollars (USD) for reporting purposes.

The current organizational chart is shown below:

MB-310 Microsoft Dynamics 365 Finance Part 07 Q13 077 Current environment

Systemwide setup

– Dynamics 365 Finance in Microsoft Azure is used to manage the supply chain, retail, and financials.

– All companies share a Chart of Accounts.

– Two dimensions are used: Department and Division.

– Budgeting is controlled at the department level.

– Customers and vendors are defined as two groups: Domestic and International.

– Mandatory credit check is set to No.

– Consolidate online is used for the consolidation of all companies.

– International main accounts are subject to foreign currency revaluation.

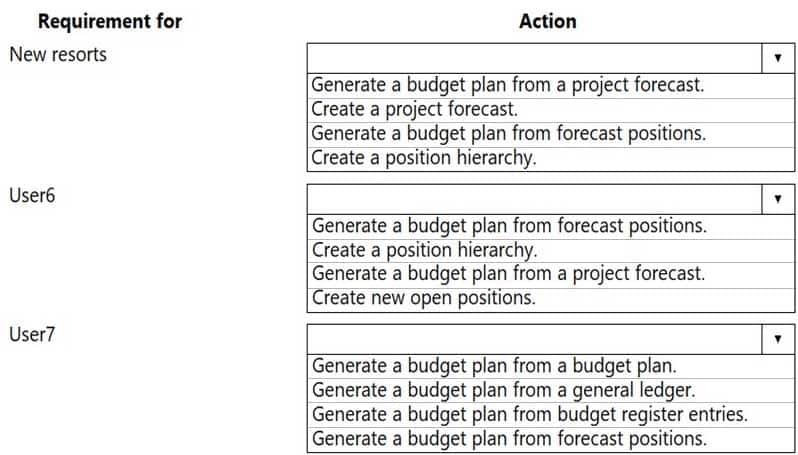

– The purchasing budget is used to enforce purchasing limits.General ledger accounts

MB-310 Microsoft Dynamics 365 Finance Part 07 Q13 078 Fourth Coffee

– The base currency is USD.

– Three item groups are used: coffee, supplies, and nonstock.

– The standard sales tax method is used.

– Acquiring fixed assets requires a purchase order.

– All customer payment journals require a deposit slip.

– Customer X is a taxable company.

– Customer Y is a tax-exempt company.

– Customer Z is a taxable company.

– Vendor A is a Colombian supplier of coffee beans and belongs to the international vendor group.

– Vendor B is a Peruvian supplier of coffee machine filters and belongs to the international vendor group.

– Vendor C is a Texas supplier of espresso valves and belongs to the domestic vendor group.Company A

– The base currency is USD.

– It consists of a marketing department and a digital division.

– A 4-5-4 calendar structure is used.

– The standard sales tax method is used.Company B

– The base currency is CAD.

– The conditional sales tax method is used.Requirements

Reporting

– A consolidated Fourth Coffee financial report is required in USD currency.

– Fourth Coffee and its subsidiaries need to be able to report sales by item type.

– Year-end adjustments need to be reported separately in a different period to view financial reporting inclusive and exclusive of year-end adjustments.Issues

– User1 observes that a General journal was used in error to post to the Domestic Accounts Receivable trade account.

– User2 has to repeatedly reclassify vendor invoice journals in Fourth Coffee Company that are posted to the marketing department and digital division.

– When User3 posts an Accounts receivable payment journal, a deposit slip is not generated.

– User4 observes an increase in procurement department expenses for supplies.

– User5 observes that sales tax is not calculating on a sales order for Customer Z.

– User6 observes that sales tax is calculating for Customer Y.

– User7 observes that the sales tax payment report is excluding posted invoice transactions.

– User8 in Company A attempts to set up the sales tax receivable account on the sales tax posting form.

– User9 in Company A needs to purchase three tablets by using a purchase order and record the devices as fixed assets.

– Customer X requires a credit check when making a purchase and is currently at their credit limit.-

You need to ensure that User9’s purchase is appropriately recorded.

Which three steps should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Select a fixed asset group at the line level.

- Set the new fixed asset toggle to yes at the line level.

- Enter three purchase order lines, enter quantity of 1.

- Enter one purchase order line, enter quantity of 3.

- Select a financial dimension at the line level.

-