MB-800 : Microsoft Dynamics 365 Business Central Functional Consultant : Part 02

-

Monetary amounts for local currency must always display three decimal places.

In General Ledger Setup, you need to configure the appropriate setup field with the appropriate value.

What should you do?

- Set the value of Amount Decimal Places to 3:3

- Set the value of Unit-Amount Decimal Places to 3:3

- Set the value of Inv. Rounding Precision to 0.001

- Set the value of Unit-Amount Rounding Precision to 0.001

- Set the value of Amount Rounding Precision to 0.001

-

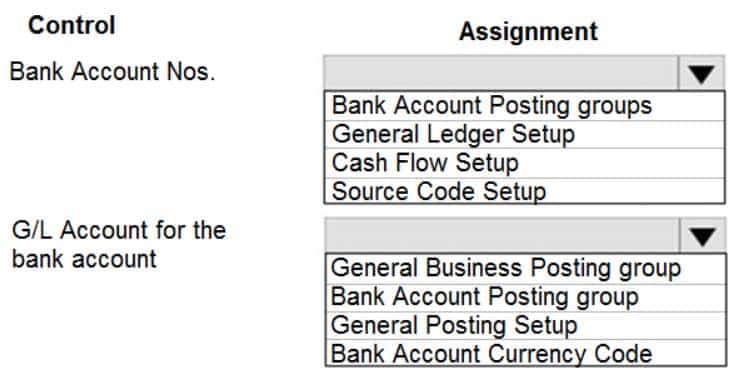

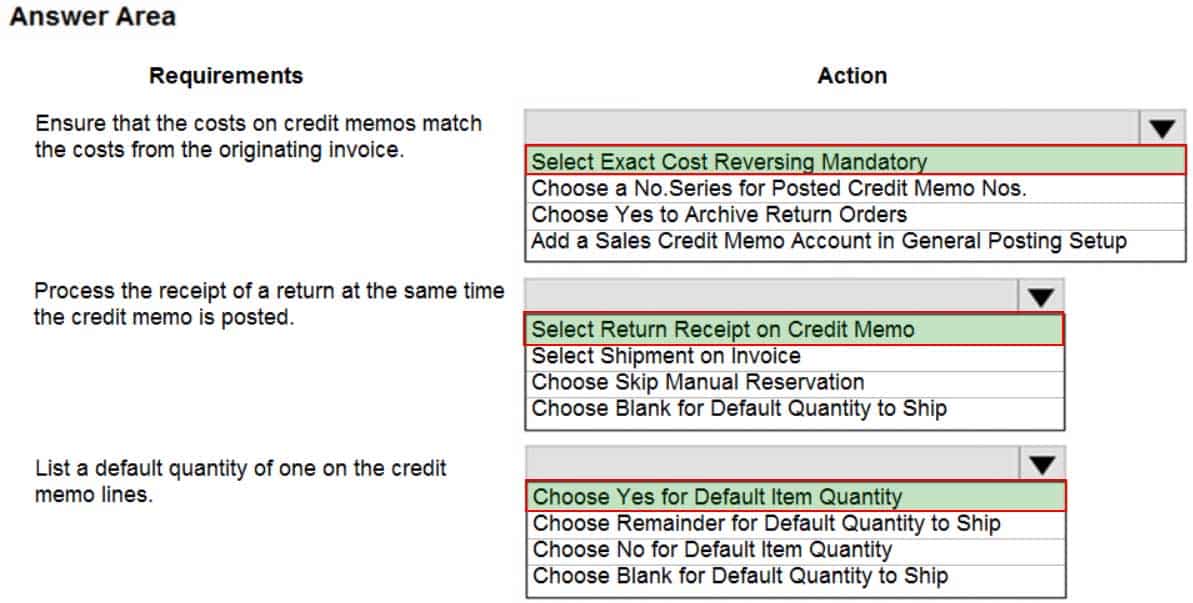

HOTSPOT

A bank is implementing Dynamics 365 Business Central.

Each bank account must be configured to a unique G/L Account.

You need to set up the first bank account.

How should you configure the system? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q02 015 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q02 015 Answer -

A company has been using Dynamics 365 Business Central for many years.

A new accounting manager for the company reviews the chart of accounts. The manager wants to remove some general ledger accounts.

The Check G/L Account Usage field is selected in the General Ledger Setup.

You need to assist with the account deletions.

What is one requirement that enables deletion of a general ledger account?

- The account cannot be used in any posting groups or posting setup

- The account cannot be used in any account schedule.

- The general ledger account cannot allow for direct posting.

- The account must have ledger entries.

-

The general ledger account for accounts receivable must match the sum of all balances on the customer cards.

You need to set up the general ledger account card for accounts receivable to meet this requirement.

What should you do?

- Configure the account type.

- Block the account.

- Configure totaling.

- Disallow direct posting.

-

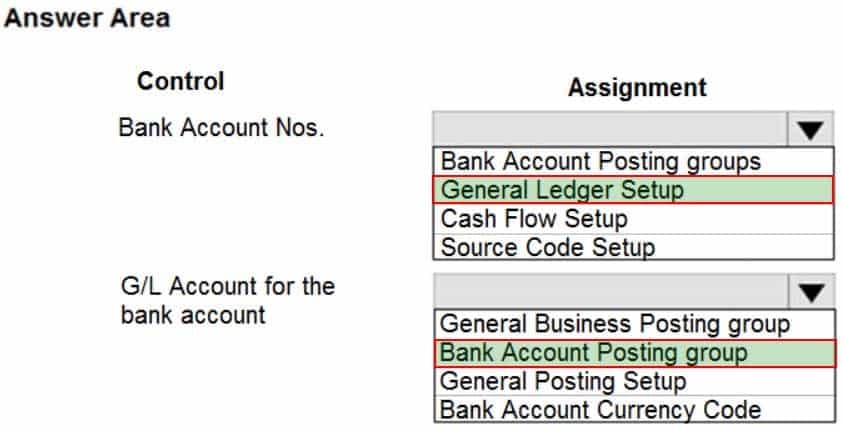

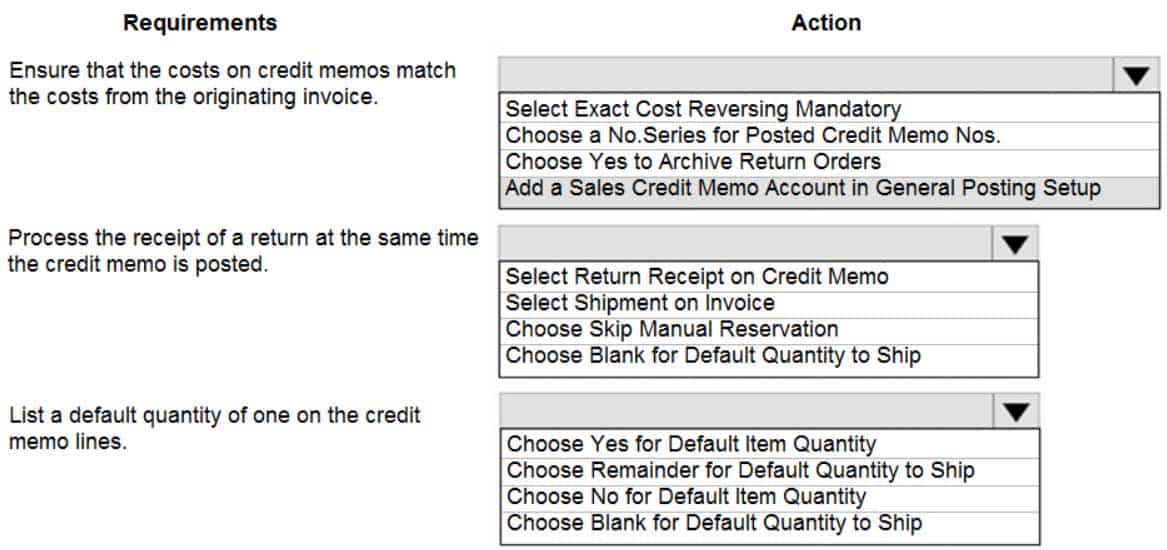

HOTSPOT

A company uses Dynamics 365 Business Central.

The company wants to automate sales credit memo processing.

You need to configure the system to meet the requirements.

What should you do? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q05 016 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q05 016 Answer -

DRAG DROP

You are implementing Dynamics 365 Business Central. The accounting manager of the company provides you with the chart of accounts.

You need to set up specific posting groups according to the chart of accounts.

Which setup should you use? To answer, drag the appropriate setup to the correct action. Each setup may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q06 017 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q06 017 Answer -

You copy a General Posting Setup from an instance of Dynamics 365 Business Central.

You must configure the General Posting Setup. You assign a category and subcategory to each account.

You need to complete the configuration as efficiently as possible.

What are three ways to complete the configuration? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- Use the Copy action to create a new General Posting Setup Card

- Import a configuration package that contains the General Posting Setup

- Use the Suggest Accounts action to create all possible posting setup combinations

- Create a new General Posting Setup Card, and then use the Suggest Accounts action

- Create a new General Posting Setup Card, and then use the Copy action

-

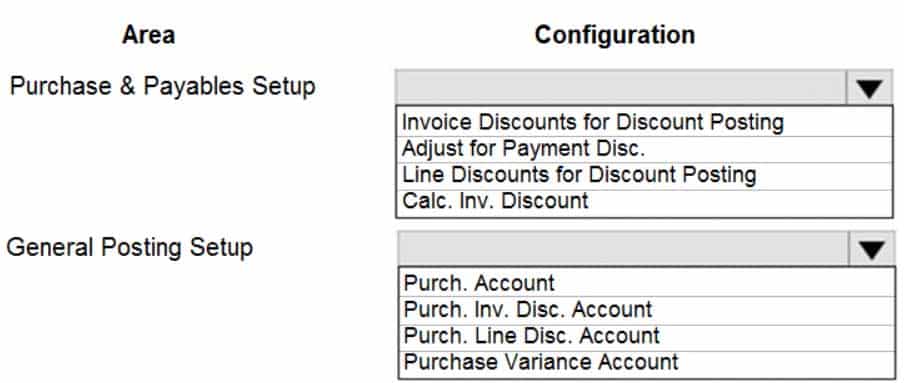

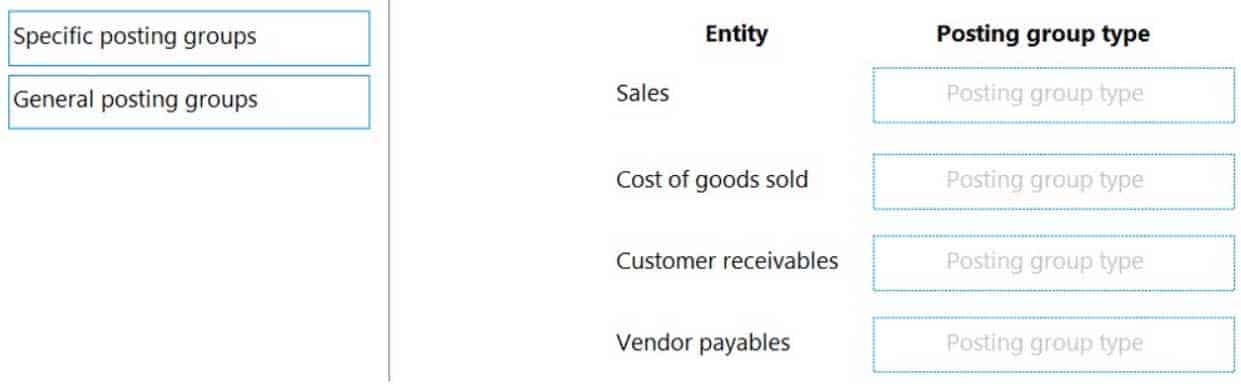

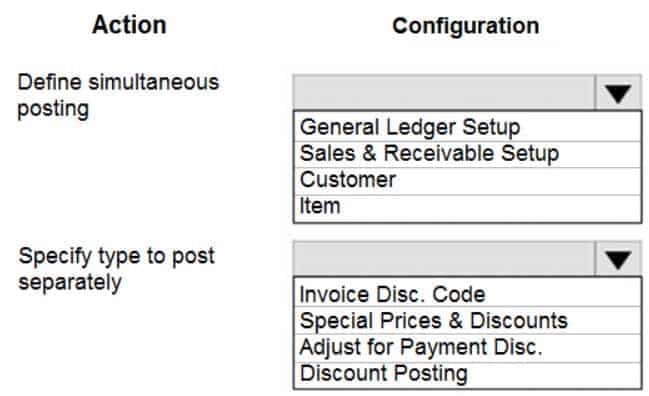

HOTSPOT

A company is implementing Dynamics 365 Business Central.

The accountant must be able to report discounts received on purchased items separately from costs.

You need to configure the system to meet the requirement.

How should you configure the system? To answer, select the appropriate configurations in the answer area.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q08 018 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q08 018 Answer -

A company is implementing Dynamics 365 Business Central.

The company needs to post monthly general journal batches for purchase expenses incurred throughout the month. The posted entries must have unique incremental document numbers. The numbers must increment by one and be sequential.

You need to configure the system to meet the requirements.

Which three actions should you perform in sequence? Each correct answer presents part of the solution.

- Create a Template Batch with Posting No. Series.

- Create the No. Series.

- Configure a General Journal with Purchase Reason Code.

- Configure a General Journal Template with Purchase Type.

- Create a Template Batch with No. Series.

-

DRAG DROP

An accountant discovers inconsistencies between financial statements and balances in the chart of accounts.

You suspect that the discrepancies might be a result of missing categories and subcategories.

You need to ensure that the financial statements match the chart of accounts.

Which three actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q10 019 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q10 019 Answer -

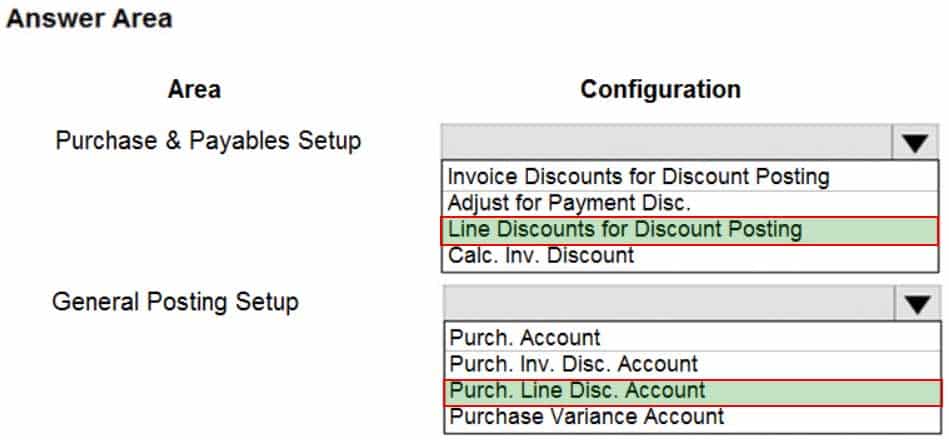

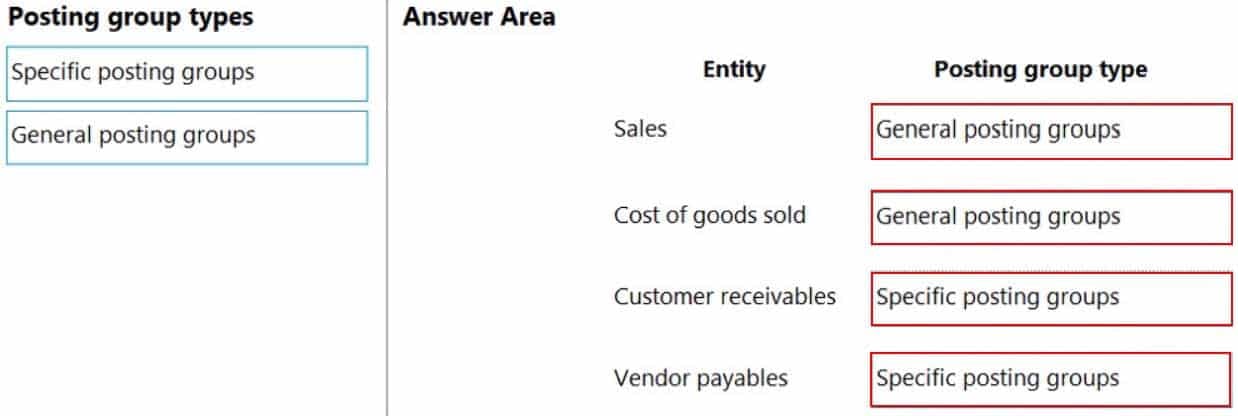

DRAG DROP

You set up a new company for a customer. The customer provides you with the chart of accounts and the preferred grouping of items, vendors, and customers.

You must ensure that item posting corresponds with the grouping preferences and chart of accounts for the customer.

You need to create the posting groups and setup.

Which type of posting groups should you create? To answer, drag the appropriate posting group types to the correct entities. Each posting group type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q11 020 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q11 020 Answer -

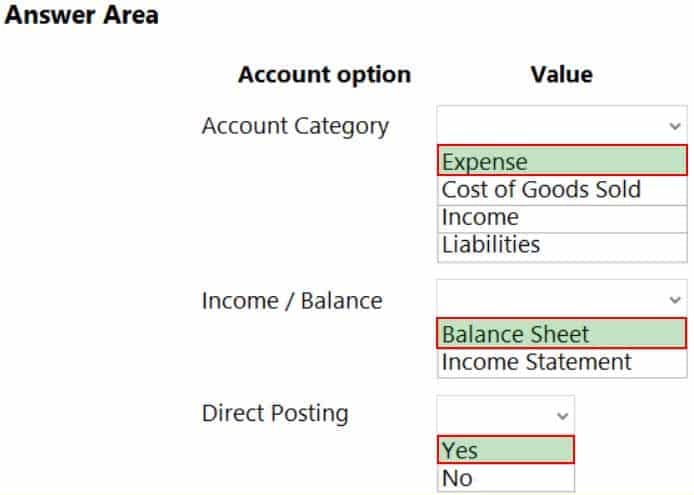

HOTSPOT

You are implementing Dynamics 365 Business Central.

You are creating an expense account for office supplies in the chart of accounts. The account may be used for purchase invoice transactions as well as general journal transactions.

You need to configure the remaining options for the account.

Which values should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q12 021 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q12 021 Answer -

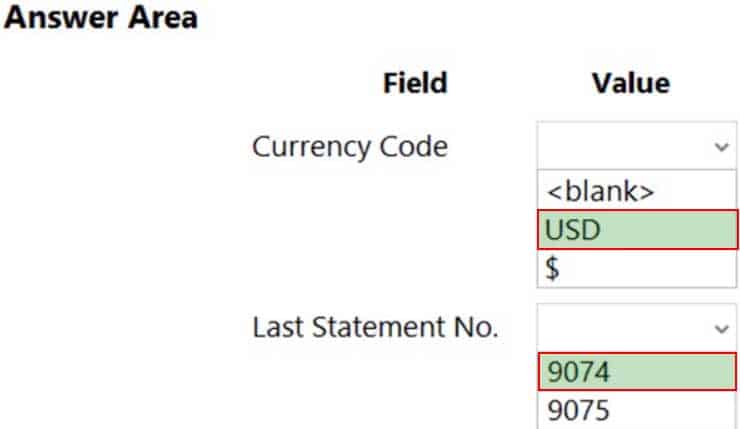

HOTSPOT

You are implementing Dynamics 365 Business Central for a customer. The local currency code (LCY) for the company is set to US dollars ($).

The customer plans to set up a bank account. The customer provides the following information for the account:

– Account number

– Name

– Address

– Bank account posting groupThe account must meet the following requirements:

– Use US dollars.

– Use 9075 as the number of the next bank account statement for reconciliation in Business Central.You need to set up the account for the customer.

Which values should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q13 022 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q13 022 Answer -

You are setting up Dynamics 365 Business Central.

You need to define the Direct Cost Applied account.

Where should you define the accounts for Direct Cost Applied?

- Item Cards

- Inventory Posting Setup

- General Posting Setups

- Vendor Posting Groups

-

A company plans to verify that purchase invoices use agreed-upon prices and discounts.

The company is configuring settings on a vendor card. The company receives a validation error when creating a purchase order for the vendor.

You need to find out which setting is causing the validation error.

Which configuration option on the vendor card must you populate?

- Order address

- Location code

- Vendor Template

- Purchase Prices

- Vendor Posting Group

-

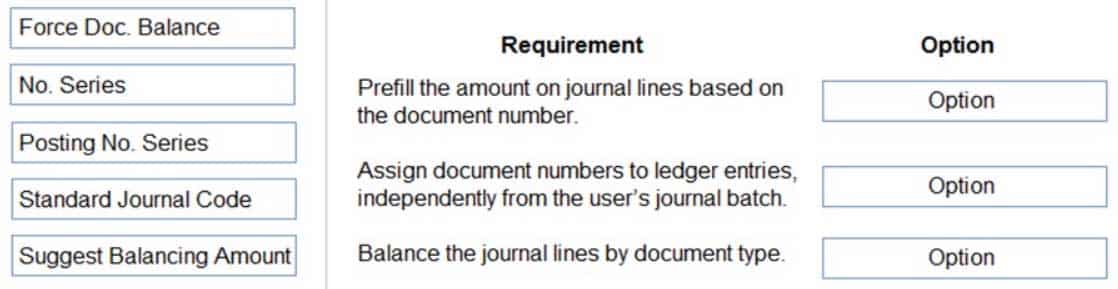

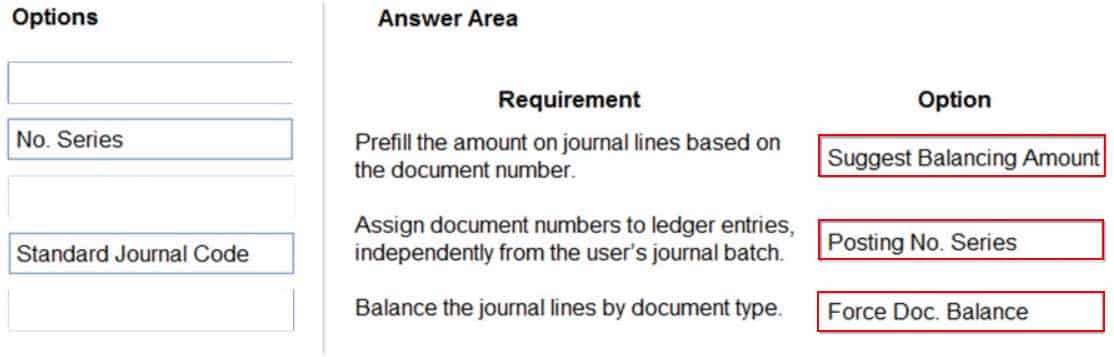

DRAG DROP

You are setting up the general journals and batches for an accounting department.

The accounting department has multiple users who will work simultaneously within different general journals.

You need to set up the different journal templates and batches for each user according to the company’s requirements.

Which options should you use? To answer, drag the appropriate options to the correct requirements. Each option may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q16 023 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q16 023 Answer - This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in the case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. When you are ready to answer a question, click the Question button to return to the question.

Background

Wide World Importers is a family-owned importer of specialty cooking ingredients and prepackaged foods from the Mediterranean. When first established, the company’s products were sold at farmers markets, All sales were on a cash-only basis.

Products are now sold locally to restaurant owners and chefs in a family-owned building with a warehouse. Products are no longer sold at farmers markets. Cash and carry sales generate most of the revenue for the company.

The founder of Wide World Importers is turning over control of the company to the younger generation in the family. These family members want to use Dynamics 365 Business Central to support their efforts to grow and diversify the business. They recently started to build a new line of business selling and shipping products to specialty retailers outside their local area through a network of brokers and representatives.

The company uses QuickBooks, but the family is concerned that QuickBooks is not capable of supporting their new business model.

There are 30 full-time and part-time employees who work in sales, purchasing, shipping, customer service, accounts payable, accounts receivable, and finance. The family does not plan to hire additional personnel to support the new line of business.

Current environment

Cash and carry sales

– When a customer makes a purchase at the company’s cash and carry desk, the sale is handwritten on a three-part form.

– The cash and carry associate retrieves the items listed on the order from the warehouse.

– Special prices and discounts are used to move products that will expire soon or that are overstocked.

– Cash is accepted for payments.

– The cash drawer is balanced at the end of every day. A deposit is created for the cash and given to the accountant.

– One-line sales invoices are saved in QuickBooks for each cash and carry sale to a miscellaneous customer.

– Customer details for cash and carry sales are not kept in QuickBooks.Brokered sales orders

– Brokered sales are called in to customer service by the brokers and sometimes directly by customers. The sales are entered into QuickBooks.

– Because inventory is not tracked in QuickBooks, the generic item Brokered Item is used.

– Two copies of the packing slip and printed from QuickBooks and sent to the warehouse.Order picking

– The warehouse manager provides a container and the two copies of the packing slip to a picker.

– Items that are out of stock are marked on both copies of the packing slip.

– The shipping amount is determined and written on the packing slips.

– One copy of the completed packing slip is placed in a basket for customer service.

– Completed orders are boxed up with a copy of the invoice and shipped to customers.Order invoicing

– Throughout the day, the customer service manager collects the packing slip copies and updates the invoices in QuickBooks.

– The customer service manager adds a line for shipping with the amount provided by the packer.

– The customer service manager prints a copy of the final invoice and sends it to the warehouse.

– The accountant uses Microsoft Word to create weekly invoices for all shipments invoiced in QuickBooks during the week for some customers.Deposits

– The accountant receives the deposit bag from the cash and carry sales desk at the end of every day.

– Receipts are recorded in QuickBooks against cash and carry and brokered sales based on the deposit slips.Brokers commission

– Brokers fees are paid as a percentage of sales.

– A Sales by Product/Service Summary report is run in QuickBooks every month for Brokered Item to calculate what is owned.Requirements

Customers

– Users with permission must be able to quickly add new customers.

– The original source of all customers in the accounting system must be identified to be from cash and carry or brokered sales.

– The company needs to keep a record of special price promotions given to specific customers.

– Customers must be identified with a unique general business posting group so that the correct freight G/L account is used in sales transactions.Sales

– The customer source must be used to identify the business line, and the customer source must be indicated on every sales transactions.

– Customer service and cash and carry desk associates must be able to enter sales into Dynamics 365 Business Central by customer.

– Excess paper must be eliminated, and paper management must be reduced.

– If a customer is not already listed in the system, a cash and carry associate or customer service associate must be able to quickly add the new customer in the process of recording the first sale.

– A point-of-sale system is not needed, but users must be able to record which items are purchased by customers, accept and record their payment, and print receipts indicating paid in full.Items

– The sales manager and warehouse manager must be able to set a specific timeframe for special promotion discounts on items.

– For special promotions, discounts must be consistent for all items in a product line using a single discount calculation.

– Special pricing may be given to a retail chain or buying group. This pricing must be automatically applied when an order is taken for any of these customers. The original price must be recorded with each sale.

– Customers must always be charged the lowest amount for an item at the time of the sale. For example, an overstocked olive oil has a regular price of $20 per unit. Customers in a buying group for restaurants can buy it for $18 per unit. There is an autumn promotion price for the item at $19 per unit. However, on a specific day only, there is an overstock special at a 15 percent discount off the regular price.Sales invoices

– Warehouse workers must be able to indicate the following in the system for each order:

1. the items picked

2. the shipping charges

3. notifications, if any, that customer service needs to provide to the customer

– Items sold at a discount must show the original price, discount, and net amount on each line of the invoice. Invoices must be posted at the cash and carry desk at the time of sale. For orders, accounting must post invoices and send them to customers.

– Warehouse employees must be able to indicate what has been shipped on an order. They will use the G/L account for shipping charges. They need to use the correct G/L account for sales versus cost through proper assignment of sales and purchase accounts in the general posting setup.

– Some of the brokered customers require one invoice per week regardless of the number of orders or shipments.Accounts

– Payment terms vary by customer.

– The amount paid to brokers must be calculated from sales after invoice discounts.

– Broker vendors must be easily identifiable from other vendors in lists

– Commission paid on sales not collected within 120 days must be deducted from brokers’ next compensation payment.Reporting

Wide World Importers requires reporting on the following:

– the overall profitability of each line of business at any time for any given period

– the cost of outbound shipping in the overall profitability of sales by business line in all related reports

– freight sales and cost by account in the trial balance

– the cost of brokers’ compensation in reporting the overall profitability of sales by business line

– the effect of item discount promotions in financial statements.Issues

Pricing

– Spreadsheets are used to maintain special item pricing and discounts. The only source of product line discount information is a whiteboard in the warehouse. The price charged is frequently incorrect.

– Customers complain when they think they think they have not received the best price available. Promotions are sometimes applied in error after a special pricing event ends, for example, when discounts are offered temporarily to reduce overstock.

– Management cannot see original versus actual price on all sales. Discounts given by brokers requires spreadsheets and comparison between price list and price on sales invoice. Management needs to be able to quickly see the discount given on each sale.Payment terms

– Agreed-upon payment terms are frequently entered incorrectly on orders, causing cashflow issues.

– Invoices already paid in full exist on the sales aging reports. The frequent cause of this issue is that sales from the cash and carry desk are not indicated as cash sales and are not posted as paid in full.

– Some buying groups require that all invoices sent during a month be due on the 20th of the following month.Invoicing

– Paperwork is frequently misplaced between the warehouse, customer service, and accounting.

– Invoices that are posted in the accounting system based on shipments and invoices that are sent to customers weekly do not match due to errors transferring the data from one document to another.

– Users are selecting the incorrect freight type (expense versus sales) on purchase and sales transactions, making it difficult to reconcile freight costs.

– Sales placed from the cash and carry desk by customers originally acquired through a broker are not being recognized with the correct customer source. Reporting by business line is inaccurate.Accounts

– Users often forget which fields to use to enter information when they add new customers to QuickBooks. This results in errors and inconsistencies in data and affects sales reporting. Confidence in sales reporting accuracy is low.

– Adding new brokers is a different process than adding other purchase vendors. Users often forget which fields to select and how to correctly assign the vendor number to add new brokers.

– Manual entries to certain G/L accounts cause reconciliation issues.-

You need to configure sales for the cash and carry desk.

What should you select?

- Payment Service

- Direct Debit Mandate with a value of OneOff for Type of Payment

- Payment Method with a value of Bank Account for Balance Account

- Payment Terms with a value of 0D for Due Date Calculation

-

HOTSPOT

You need to configure the sales invoices to show the discounts.

How should you configure the system? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q17 024 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q17 024 Answer -

HOTSPOT

You need to resolve the reconciliation issues.

How should you complete the setup? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q17 025 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q17 025 Answer -

You need to set up payment terms for buying groups.

Which two actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Set up payment terms with a value of CM+20D for the due date calculation.

- Assign the payment terms to the customer price group.

- Assign the payment terms to the customer.

- Assign the payment terms to the customer posting group.

- Set up payment terms with a value of D20 for the due date calculation.

-

- This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in the case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. When you are ready to answer a question, click the Question button to return to the question.

Background

Best for You Organics Company is a mid-sized wholesale distributor of organic produce and other food items to national retail grocery store chains. Over half the company’s revenue is from produce with an average shelf life of less than a week. The remaining revenue comes from shelf-stable canned and packaged items.

Best for You Organics experienced substantial growth in the last two years. They expanded from one location to three locations, increased the number of employees from 25 to over 100, and more than doubled their revenue. The company’s business forecast predicts a steady rate of growth of at least 20 percent annually for the next five years.

As a result of their expansion, Best for You Organics is experiencing delays and bottlenecks in their processes. The company has decided to implement Dynamics 365 Business Central as a new Enterprise Resource Planning (ERP) solution to increase efficiency and automation to support their continued growth.

Current environment

Deliveries

– The company receives daily truckloads of products from their vendors, warehouses the products briefly, and then ships orders based on a weekly delivery cycle to each customer’s store.

– Customers have regular standing orders that are revised and finished one week prior to delivery.

– Best for You Organics has a fleet of trucks that make deliveries according to planned routes.

– The company also has a floating route for trucks to deliver rush orders. The route is being used more often by customers and has overwhelmed the warehouse with exception processing.Duties

The company wants to provide greater separation of duties between activities in the office and activities in the warehouse.

The accounting team enters orders for the sales team, sends pick tickets back to the warehouse, and organizes shipping documents. The accounting team invoices the orders when they receive instructions from the warehouse that an order shipped.

Employees have expressed frustration because they need to work longer hours to accommodate the increase in sales.

The company does not use the Advanced Warehousing function.

Requirements

Salespeople

– Salespeople must be able to manage opportunities that are converted to quotes.

– Salespeople must be able to release orders to the warehouse to be fulfilled once a quote is final.

– Salespeople must be trained on how to determine if inventory is available when they are completing the quote to avoid promising inventory that is not on hand because all orders are processed one week in advance of delivery.Team responsibilities

Deliveries must be shipped daily by employees in the warehouse. The office must be responsible for completing the invoicing process.

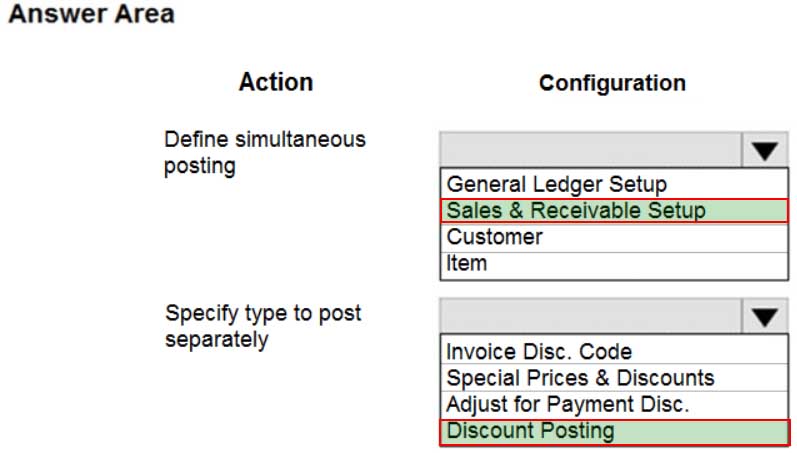

The current team responsibilities are shown in the following graphic:

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q18 026 The required team responsibilities are shown in the following graphic:

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q18 027 Vendor management

– The company contracts with each vendor for regular discounts at the invoice level.

– The company requires a pre-set discount percentage to calculate automatically when the purchaser completes a purchase order.

– The company must be able to see a copy of the completed purchase order in the system when they have new contract negotiations with their vendors.Customer and inventory management

– Sales invoices must be automatically emailed by the system to customers.

– A template must be used for emails sent to customers. The template must not be altered.

– Customers who pre-pay their invoices must not receive a copy of their invoices.

– The company warehouses all products as Case quantities. The company has difficulty recording accurate costs for product returns. The company wants to expand their capabilities for managing returns by setting up all inventory in a quantity of Each.Reporting

The company must be able to answer two key questions when they report financial results:

– Which customers are buying which items?

– Which salespeople are selling in which regions?When discussing customers, the company must refer to each Customer Group as follows:

– Big Box

– Franchise

– PrivateWhen discussing items, the company must refer to each Item Group as follows:

– Fair Trade

– Free Range

– Grass Fed

– Heirloom

– OrganicSalesperson names that must be used are:

– Salesperson A

– Salesperson B

– Salesperson C

– Salesperson DRegion names that must be used are:

– North

– South

– East

– WestCommission

– The company must be able to track salesperson performance within certain regions to calculate commission.

– Each salesperson must be assigned only to a single region.

– This commission data is currently recorded inconsistently, resulting in incorrect combinations that require manual correction. The company must have some level of automation to manage this.Issues

Issue 1

The accounting team needs an improved process for reconciling inventory to the general ledger.

– Posted transactions are changing financial reporting in periods that have been closed.

– Unexpected changes in inventory cost for previous months are causing costing inaccuracies.

– The system must restrict the adjustment of costs for closed months.

– The new policy will be to restrict all users to posting in the current month only, with the exception of a few employees from the accounting team.

– The calendar fiscal year for company must begin on June 1.Issue 2

The accounting team uses a complex manual accrual process to determine the accounting impact of items received but not invoiced. The system must streamline the item accrual process.

Issue 3

The company often receives a higher quantity of produce items than what they order because vendors allow for spoilage or damage of produce in transit. The company does not want to allow over receipt on non-produce items.

Issue 4

The company has received comments from their auditors that invoices are not being properly compared to received inventory documents before they are posted. The company does not use warehouse management and always handles processes directly from the purchase order. The company always has the following documents:

– purchase order from the procurement department

– receiving document from the warehouse

– electronic invoice from the vendor-

HOTSPOT

You need to set up a new fiscal year and restrict posting.

Which options should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q18 028 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q18 028 Answer -

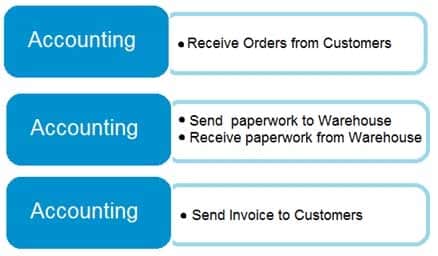

HOTSPOT

You need to configure purchase order discounting and history.

What should you do? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q18 029 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q18 029 Answer -

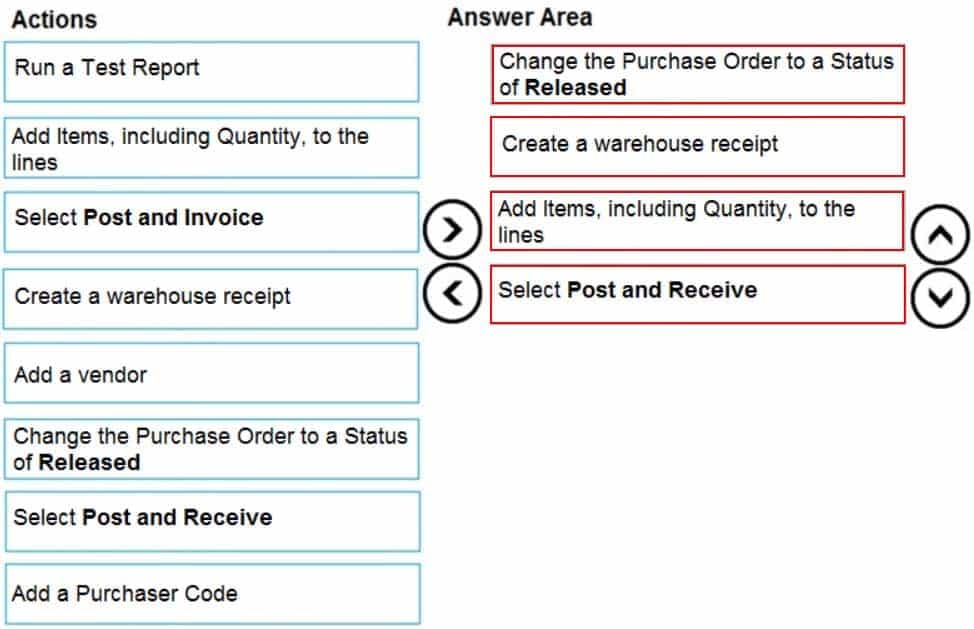

DRAG DROP

You need to configure the purchase order process to meet the auditor’s requirements.

Which four actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q18 030 Question

MB-800 Microsoft Dynamics 365 Business Central Functional Consultant Part 02 Q18 030 Answer -

You need to configure the system to meet the requirements for sending invoices.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Set Email to Yes (Use Default Settings).

- Allow Sender Substitution for SMTP Mail Setup.

- Set Email to Yes (Prompt for Settings).

- Assign a Document Sending Profile to the Customer where Email is set to No.

- Apply Office Server Settings to the SMTP Mail Setup.

- Assign a Document Sending Profile to the Customer where Email is set to Yes.

-

-

A company configures special prices for a combination of an item number and a vendor.

You need to configure optional criteria for special pricing to calculate the best price for the combination.

Which three criteria should you use? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- Purchasing Code

- Minimum Quantity

- Unit of Measure Code

- Currency Code

- Line Discount Percentage

-

You are implementing Dynamics 365 Business Central for a customer who has two warehouses.

The customer requires the following:

– different item pricing and vendors set up for items in each warehouse

– transactions tied to a specific locationYou need to configure Business Central per the customer requirements.

Which three entities should you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Inventory setup

- Warehouse setup

- Stockkeeping units

- Item card

- Locations